The Future of Captive Insurance: Family Offices and Commercial Insurance

The landscape of captive insurance is undergoing significant changes driven by various factors, including regulatory shifts, international tax developments, the emergence of family offices/private investment offices, and the hardening commercial insurance market. These developments have necessitated the adoption of strategic risk management strategies to safeguard and grow multigenerational wealth in the investment space.

Captive insurance, which involves the creation of a subsidiary insurance company to cover the risks of the parent company or its affiliates, has traditionally been a popular risk management tool for corporations. However, many states have begun licensing captive insurance companies making them a viable strategy for small and middle-market businesses.

Simultaneously, the rise of family offices and private investment offices as a means of managing and preserving wealth across generations has brought about a new demand for strategic risk management strategies. Family offices, which oversee the financial affairs of affluent families and businesses, require comprehensive risk management plans to protect their assets and mitigate potential liabilities. As family wealth is often dispersed among various investments and holdings, the need for tailored risk management solutions becomes crucial to ensure long-term wealth preservation.

Strategic risk management strategies for family offices involve the use of captive insurance companies to address specific risks that traditional commercial insurance may not adequately cover. By establishing a captive insurance entity, family offices can customize insurance coverage, manage deductibles, and have greater control over claims management. This approach allows them to address the unique risks associated with their investment portfolios, real estate holdings, and other assets, ultimately minimizing their exposure to potential losses.

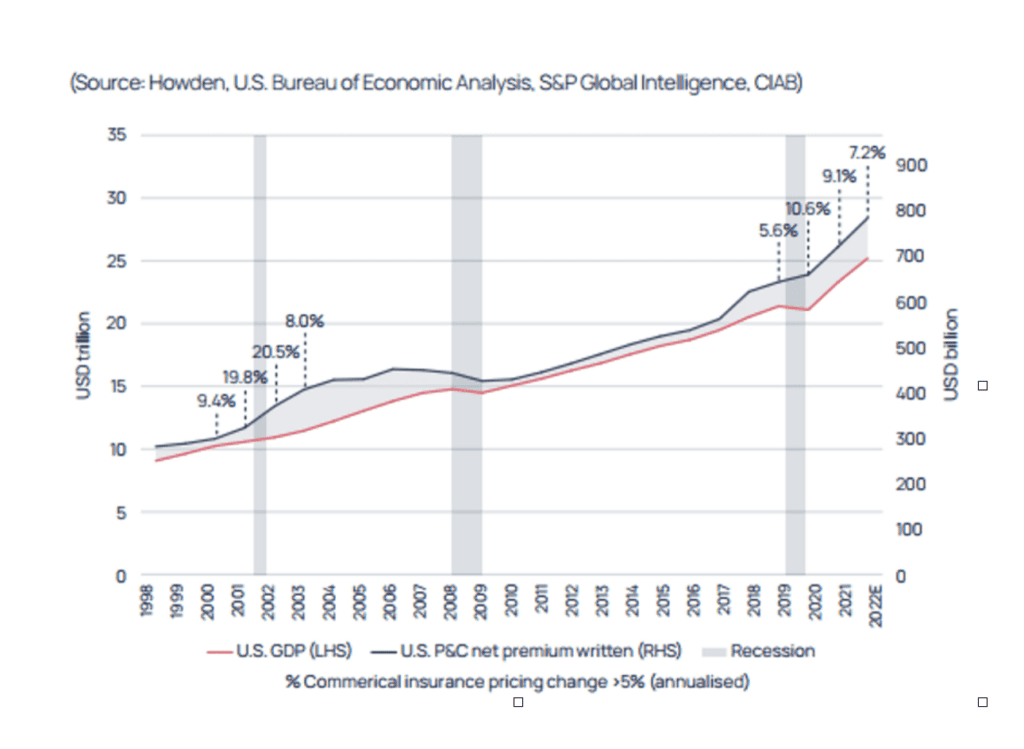

Moreover, the current hardening commercial insurance market has further highlighted the importance of captive insurance for family offices. As commercial insurance premiums rise and coverage becomes more restrictive, family offices are increasingly exploring captive insurance as an alternative risk transfer mechanism. By assuming a portion of their own risks through captives, family offices can better manage costs, maintain coverage for specialized risks, and gain greater control over their insurance programs.

The landscape of captive insurance is being shaped by proliferation of threats to the businesses and wealth of families who look to family offices for advice and the hardening commercial insurance market. Family offices can best serve their clients by adopting strategic risk management strategies to protect and grow their multigenerational wealth. Captive insurance provides them with the flexibility and control they require to address the unique risks associated with their diversified portfolios. By leveraging captives, family offices can mitigate potential liabilities, ensure comprehensive coverage, and safeguard their clients’ wealth for future generations.