EnviroCap

How EnviroCap Works

For many businesses, loss claim frequencies tied to environmental issues can be quite low, but the costs for traditional insurance can be astronomical, particularly depending on one’s industry.

EnviroCap Program

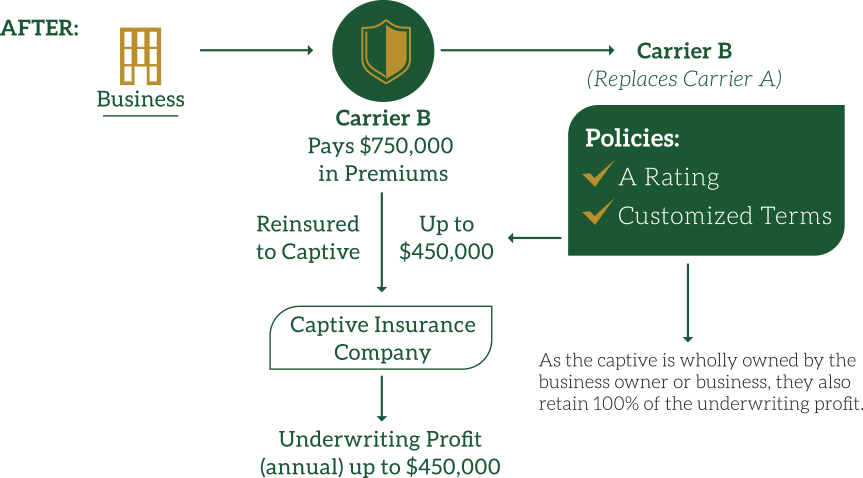

EnviroCap allows insured businesses to reinsure their commercial insurance premiums to a captive insurance company their own and retain up to 60% of their premiums and risk.

Anatomy of EnviroCap

Insurance

Captive insurance is often less expensive than commercial insurance. Captives are licenses insurance companies and have access to reinsurance markets (wholesale).

And, you own the insurance company, so the premiums are paid to you–you keep the profit after claims are paid out.

For example, if your insurance company receives $750,000 in premiums, pays $50,000 in operations, pays $50,000 in claims and pays $200,000 for reinsurance and fronting, then you have $450,000 in profit.

Investment Income

Invest large, tax deferred part of funds. As an example, after one year, at 5% interest, you’ve earned $10,500.

Insurance Reserves

Using the same example, the insurance company has $220,500 at the end of year one.

In short, EnviroCap does the following:

Introducing EnviroCap

For more information on how EnviroCap works, watch this video:

Contact CIC Services

Find Out How CIC Services Can Help Your Company