Yellow Fever – Section 179 Versus A Captive Insurance Company

I was recently talking with a CPA who told me he has been encouraging one of his best clients to form a captive insurance company. It seems that every Fall his client contracts “Yellow Fever” and in this smitten state, he purchases new construction equipment to lower his taxable income.

This CPA told me that he often tells his client:

When I first met you, you were poorer than me. Then, you were richer than me. Then, you were poorer than me. Now, you’re richer than me again. And, I want to make sure you stay that way!

Which explains why he is encouraging this successful business owner to form a captive insurance company. By owning a captive insurance company, businesses can:

- Significantly improve risk management

- Lower commercial insurance costs

- Address unexpected losses

- Become asset protected

- Create a liquid reserve to weather an economic downturn

The last bullet is the most poignant in this case. The 2008 economic downturn significantly hurt many business owners that were asset heavy and cash light, forcing many into bankruptcy and ruin.

Over the last few weeks, we have addressed the impact of tax reform on captive insurance companies. And, last week, we compared the benefits of a Captive Insurance Company to a Section 179 Deduction.

The recent Tax Reform legislation also impacted The Section 179 Tax Deduction, increasing it from $500,000 to $1,000,000 for qualified capital purchases.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if a business buys (or leases) a piece of qualifying equipment, it can deduct the FULL PURCHASE PRICE from its gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Some questions to consider when comparing a Captive Insurance Company to a Section 179 Purchase are:

Which will make the business healthier and stronger and more likely to survive economic and business uncertainties?

Which could improve risk management and lower insurance costs?

Which would provide liquidity in the event of an economic downturn?

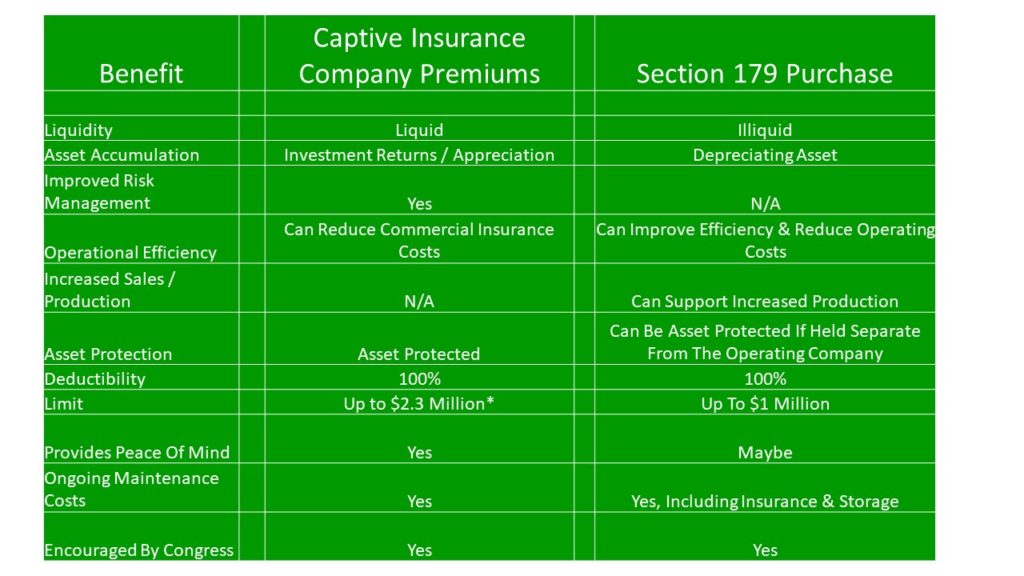

These are important questions, and the table below provides a great framework for comparing the benefits of small Captive Insurance Companies with Section 179 Capital Purchases for mid-market and small businesses.

* Eligible for 831(b) election; Captives receiving premiums above $2.3 million are not eligible for 831(b).

While capital investment is an important aspect of a growing, healthy business, it often makes powerful business sense to balance it with approaches that improve risk management, asset protection and help stockpile cash for the future.

If you own a successful business, and you’re richer than your CPA, and you want to stay that way…

owning a captive insurance company may be the right move for your business.