New Legislation – What’s A Captive Owner (Or A Prospective Owner) To Do?

Over the last few weeks, we have addressed the “Tax Extenders” bill titled H.R. 34. As noted, this new legislation included Section 262 titled, “MODIFICATIONS TO ALTERNATIVE TAX FOR CERTAIN SMALL INSURANCE COMPANIES.” These modifications impact small captive insurance companies (CICs) that make an 831(b) tax election (CLICK HERE to read about H.R. 34 and Section 262).

We noted that the legislation’s “diversification requirements” have created quite a stir in the captive insurance industry. Some industry pundits and domicile regulators have suggested H.R. 34 will put a significant dent in the captive industry, particularly small captive insurance companies that make an 831 (b) tax election (CLICK HERE to read about the 831(b) tax election). These captives largely serve small and mid-size businesses – the very businesses that form the backbone of the U.S. jobs market (CLICK HERE to read about small and mid-size businesses and captive insurance companies).

We believe such allegations are quite exaggerated, as we will explain below.

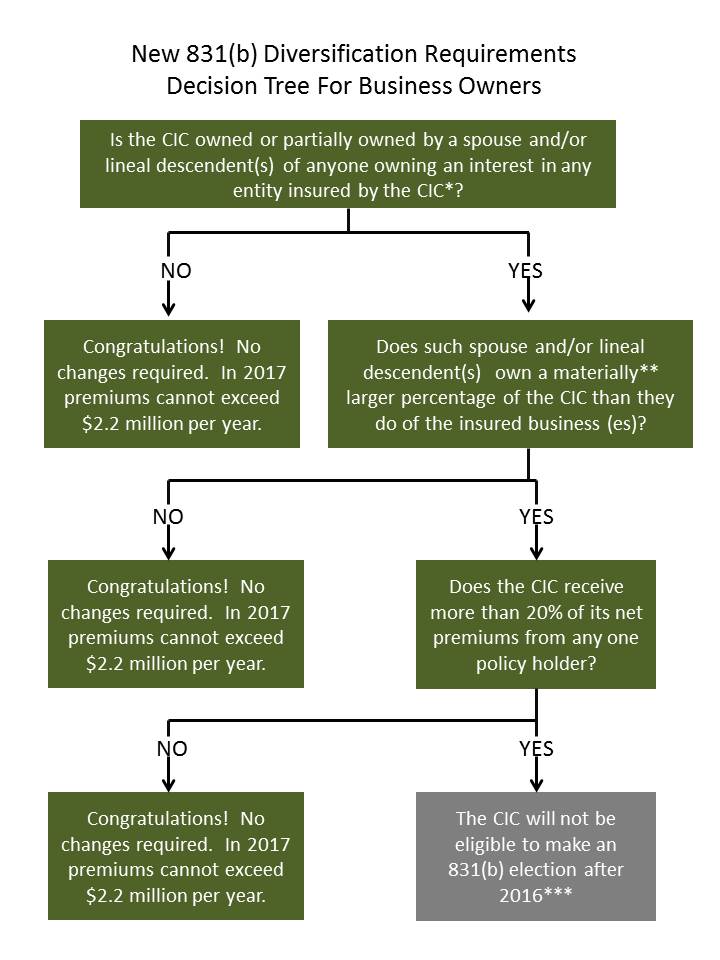

Last week, we shared the decision tree below to aid existing or prospective CIC owners in determining if their captive meets the new requirements of H.R. 34.

* For instance, does your spouse or child own, directly or indirectly (for instance via a trust)any portion of your CIC?

** “Material” means more than 2%.

*** There are numerous options available to CIC owners to enable them to continue to reap the benefits of CIC ownership, continue to make an 831(b) election, and increase premiums paid to their CICs up to $2.2 million in 2017.

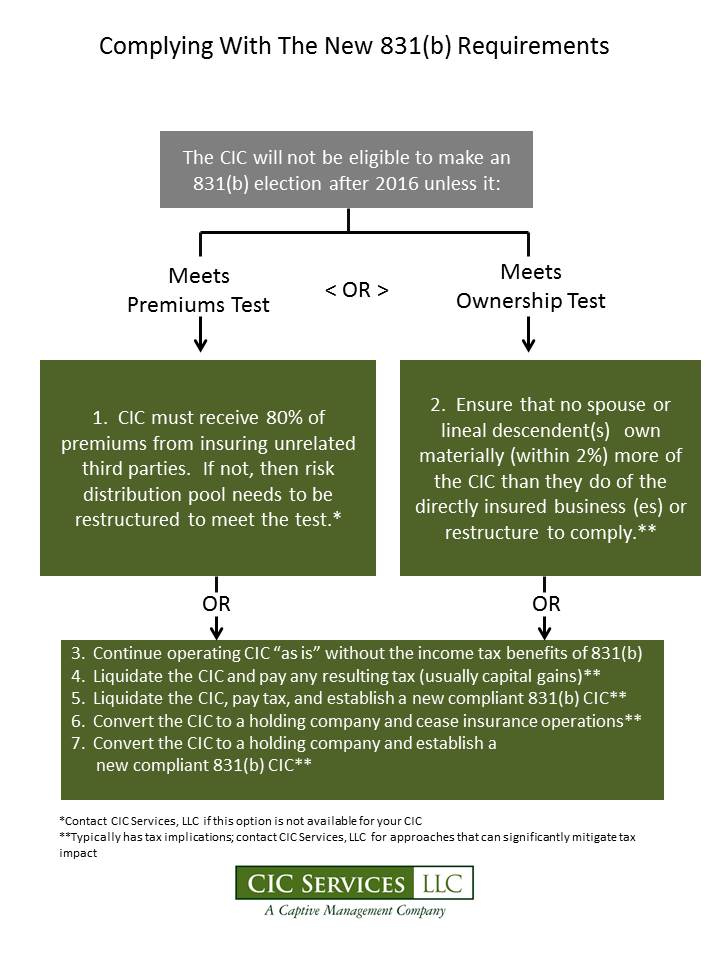

As you can see from the 831(b) Decision Tree For Business Owners, many small captives will require no changes going forward. Captives that fall into the grey box will not be eligible to make an 831(b) election after 2016. However, all is not lost. There are numerous approaches or structure changes that captives falling in the grey box can make to maintain their 831(b) eligibility as the chart below illustrates. The chart below begins with the grey box from the previous decision tree.

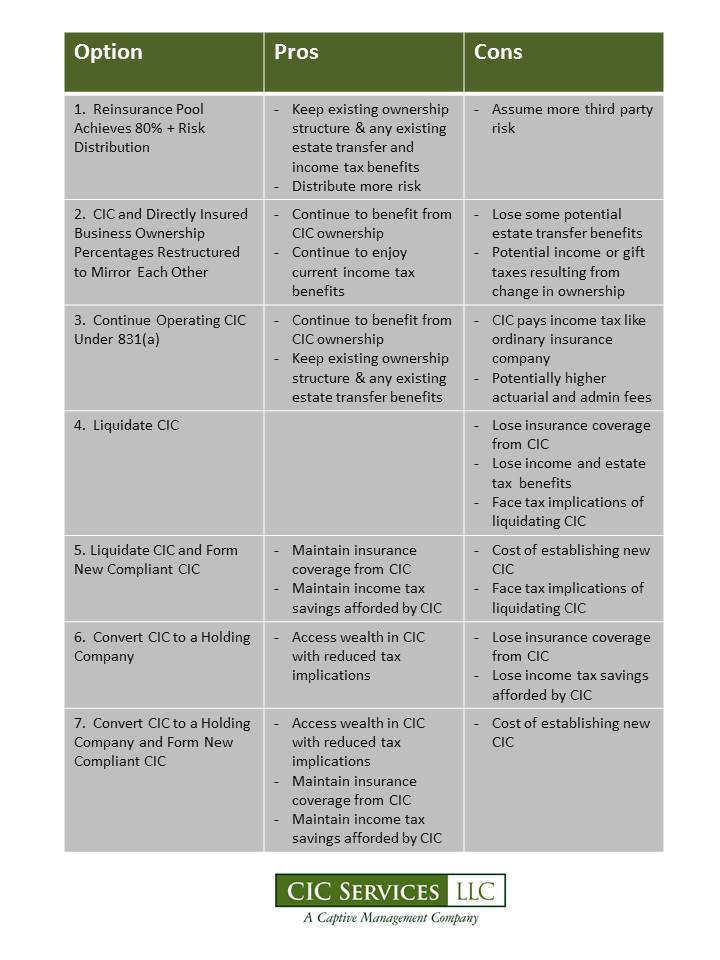

The chart above outlines 7 potential routes CIC owners can take if their CIC is adversely impacted by H.R. 34. The table below explores the Pros and Cons of each potential approach.

CIC Services, LLC will be reaching out to our clients to discuss whether or not their CIC meets the new requirements imposed by H.R. 34 and options available to ensure compliance by 2017.

If you own a captive that makes an 831(b) election or are considering captive ownership, reach out to us for a more thorough explanation of the new “diversification” requirements of H.R. 34 and approaches to structure your CIC to achieve your goals.

Note: This does not constitute legal advice. Specific circumstances may vary from one CIC owner to another.