Breaking It Down – The Impact Of Tax Reform On Small Captive Insurance Companies

Two weeks ago, we addressed the impact of tax reform on captive insurance companies. This week, we will specifically focus on small captives that make an 831(b) tax election and insure pass-through entities (S Corporations, Limited Liability Companies, Partnerships, Sole Proprietorships, Hedge Funds, etc. ).

Refresher From 2 Weeks Ago

Below is a brief recap from our article two weeks agoThe initial stated aim of the Tax Cuts and Jobs Act was to simplify the tax code, “so most tax returns could be filled out on a post card.” It does NOT achieve that aim. While providing tax relief to many individuals and businesses, the new tax law is anything but simple.

- The initial stated aim of the Tax Cuts and Jobs Act was to simplify the tax code, “so most tax returns could be filled out on a post card.” It does NOT achieve that aim. While providing tax relief to many individuals and businesses, the new tax law is anything but simple.

- Every Captive is a winner. All captive insurance companies being taxed in the United States benefit from the new tax law.

- “Small” captive insurance companies that make an 831(b) tax election will still be taxed at zero percent (0%) on their underwriting profits (no change from the prior year).

- Unlike prior years, captives now have the added benefit of having their investment income taxed at the lower 21% corporate rate.

- The risk management benefits of captive insurance companies are unaffected by the new tax law.

- Captive insurance policies and the coverages they provide are not impacted either.

- Fronting, reinsurance, and risk pooling commonly employed by captive insurance companies remain unchanged.

Impact Of The New Tax Law On Small Captives Insuring Pass-Through Entities

First, it should be reemphasized that captive insurance companies and captive taxation are not negatively impacted by these rate changes.

However, the tax benefits captives provide may be reduced (but not eliminated), as the new tax law decreases parent company taxation for most businesses. This lower benefit will vary in impact from business to business and is best understood as a potential reduction in the tax arbitrage between the parent company (insured) and the captive (insurer).

The highest federal tax bracket for owners of pass-through entities in 2017 was 39.6%. Because owning a captive insurance company requires significant insurable risk which is usually a function of scale, most small captive owners in 2017 fell into the 39.6% federal income tax bracket.

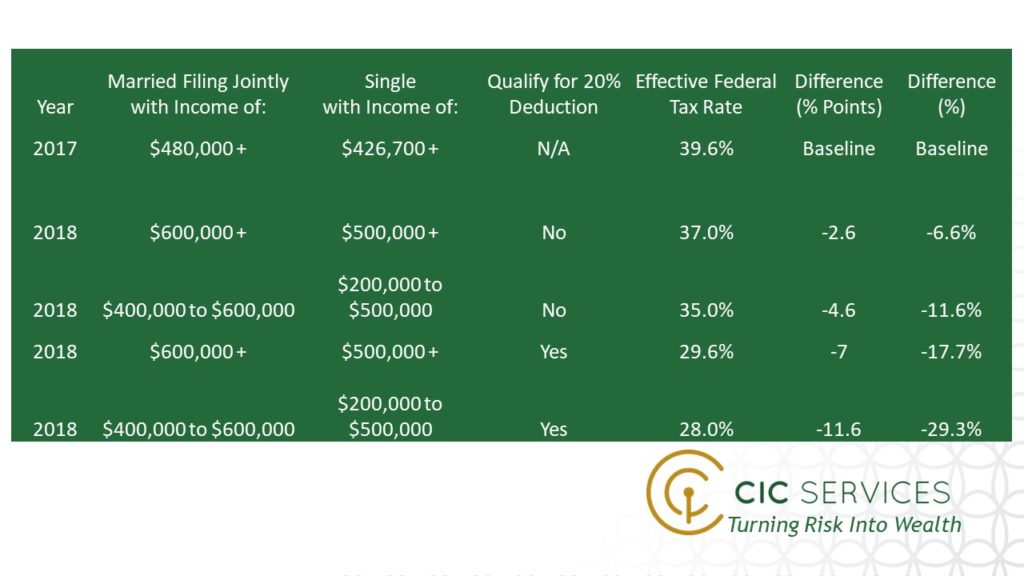

For 2018, the highest tax bracket for owners of pass-through entities will be 37%. Some pass-through entities will be allowed to deduct 20% of their income. This deduction applies largely to manufacturing and businesses that sell durable products. Specific service industries, such as health, law, and professional services, are excluded and may not take the 20% deduction. The table below summarizes the impact of tax reform on pass-through entities.

Depending on whether A) filing married / jointly or single, B) receiving the 20% deduction, and C) landing in their appropriate pass-through income bracket, effective federal tax rates for most small captive owners will be either 37%, 35%, 29.6% or 28%. The table below also demonstrates the corresponding reduction in federal income tax benefits that small captives will receive (% points difference and % difference). Compared to 2017, small captives will lose 6.6%, 11.6%, 17.7% or 29.3% of their federal income tax benefits (as illustrated in the far right column below). This analysis does not include the benefits of improved risk management, improved insurance protection, asset protection and state taxes saved.

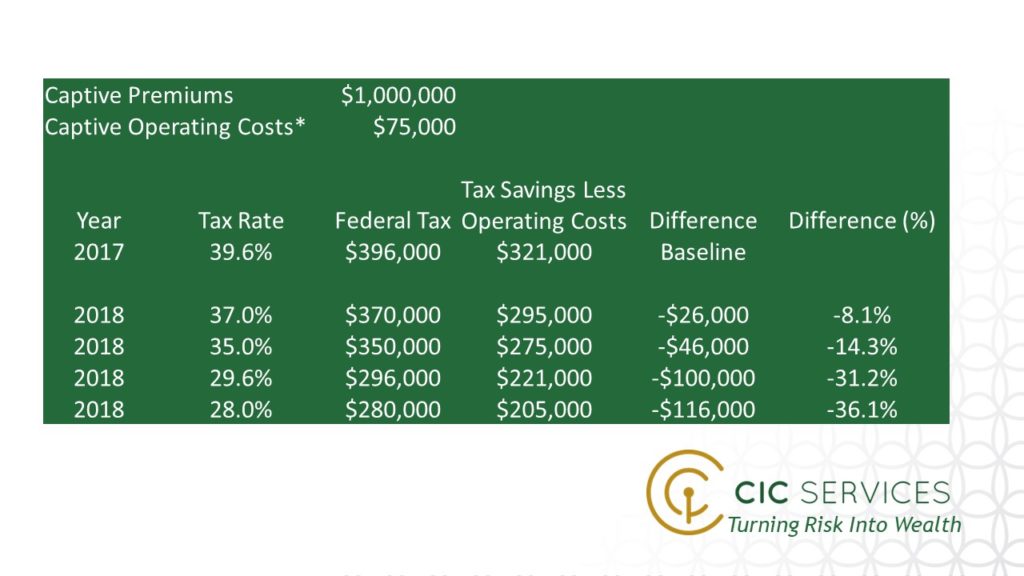

The impact of tax reform on small captives is further illustrated in the two tables below. The first table assumes captive insurance premiums paid are $1,000,000 and annual captive operating costs are $75,000. Captive operating costs may vary based on complexity.

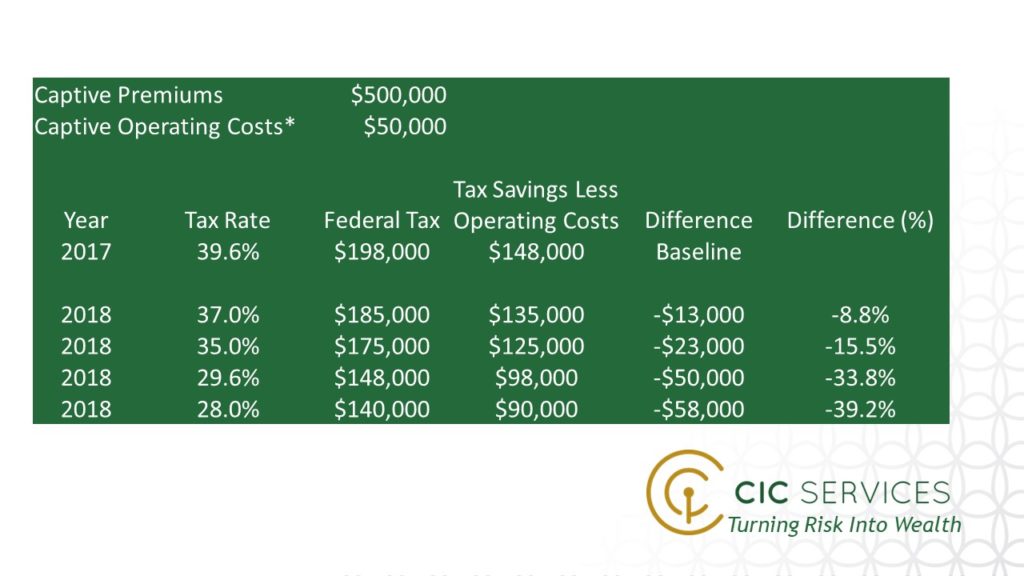

The second table assumes captive insurance premiums paid are $500,000 and annual captive operating costs are $50,000. Captive operating costs may vary based on complexity.

*Captive Operating Costs may vary and are a function of complexity

For captive premiums paid of $1,000,000 the middle column, “Tax Savings Less Operating Costs,” illustrates the federal income tax benefit of the captive at various 2018 pass-through tax brackets. As can be seen, a captive insurance company still provides significant benefits ($205,000 to $295,000 for $1,000,000 in premiums paid). The right two columns illustrate the decreased benefit of small captive ownership versus 2017 (-8.1%, -14.3%, -31.2% and -36.1%).

*Captive Operating Costs may vary and are a function of complexity

For captive premiums paid of $500,000 the middle column, “Tax Savings Less Operating Costs,” illustrates the federal income tax benefit of the captive at various 2018 pass-through tax brackets. As can be seen, a captive insurance company still provides significant benefits ($90,000 to $135,000 for $500,000 in premiums paid). The right two columns illustrate the decreased benefit of small captive ownership versus 2017 (-8.8%, -15.5%, -33.8% and -39.2%).

Apply Brute Force Logic

For most businesses, the benefits of improved risk management, improved asset protection and tax savings that a captive provides will not be sufficiently negated. Captives remain a powerful and logical choice.