CIC Services launched our Bundled Captive Insurance Program in early 2019, and it is helping successful mid-market companies with good loss control in place to reduce their net commercial insurance spend by up to 50%. But we have also noticed another interesting phenomenon. Enterprising brokers are using the Bundled Captive Insurance Program as a door opener to win away some of their competition’s best clients.

Who are some of those best clients? Well, other than friends and family members who might never leave, some of the best clients are those who are profitable and have good loss history, making renewal easier. And, here is the opportunity! Many of those “best clients” know they are “best clients,” and they want to know why their rates are increasing when their losses are low. And, they may become testy and press their current broker to find a better way.

Here is your opportunity to sound the bugle and ride in to the rescue by introducing your newfound prospect to the CIC Services Bundled Captive Program. Many middle-market companies were not large enough to consider replacing their commercial insurance through a captive – particularly a single parent captive – until now!

The CIC Services’ Bundled Program allows an insured business to do the following:

1. Replace their commercial insurance carrier with an A+ rated carrier

2. Keep their current policy language and terms

3. Keep the current policy limits

4. Keep their premium costs the same

AND…

5. The A+ rated carrier will reinsure 10% to 50% of the premiums paid by the insured to a captive insurance company owned by the insured

Captive insurance is simply a formal method of self-insurance and enables businesses and business owners to participate in risk and keep all or a portion of insurance profits. A captive is a C corporation and has an insurance license. Underwriting profit can be invested and carry over from year-to-year, making the captive stronger financially and helping to control the cost of commercial insurance. Captives can often receive favorable tax treatment to help them quickly accumulate assets and loss reserves.

Operating in concert with an A+ rated carrier, experienced underwriters and third-party actuaries, the CIC Services’ Bundled Program allows a business to own a captive insurance company without the high transactional costs and minimums that have typically closed the door to self-insurance for smaller companies. Businesses that participate in the Bundled Program are not required to purchase a fractional share of an already established group captive. Each participating business owns and controls 100% of their individual captive insurance company.

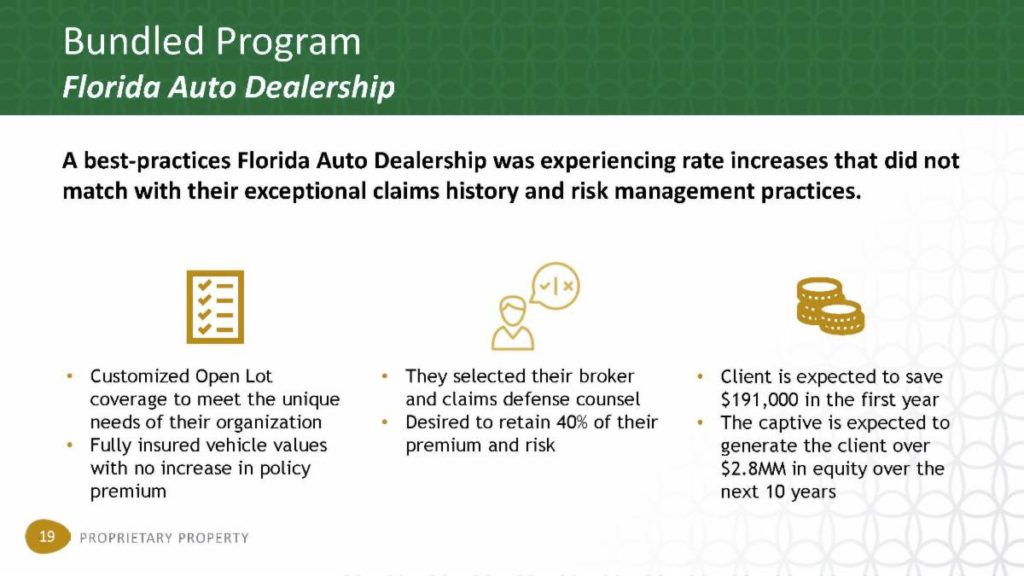

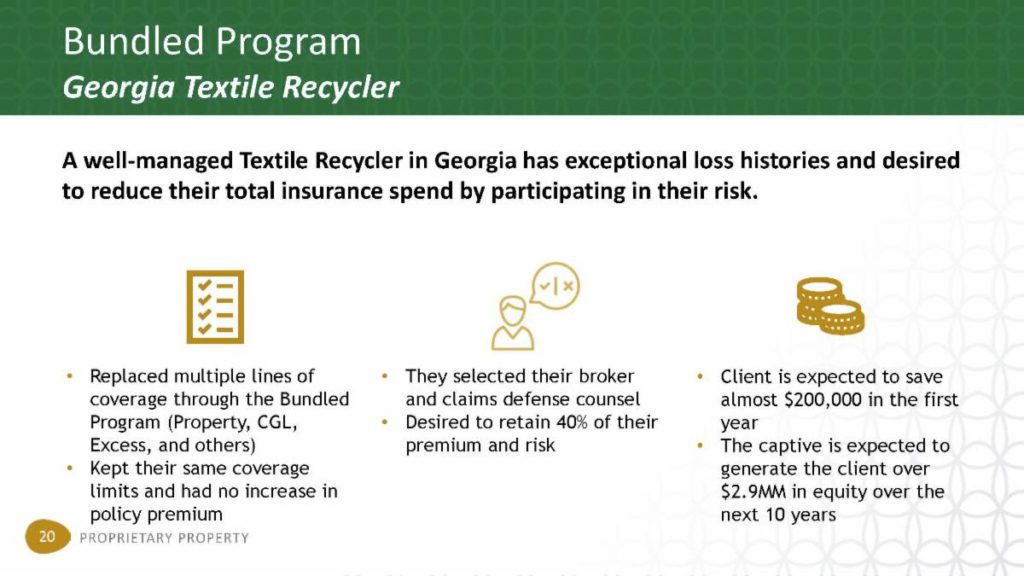

Below are three case studies to demonstrate the exciting possibilities the program offers. Don’t miss your chance to be our next case study.

Fortune favors the bold. It’s time to start winning over some of your competition’s best clients. The first step is to contact us and learn about the program.

CLICK HERE to learn more about the Bundled Captive Program.