Swiss Army Captive Insurance Company

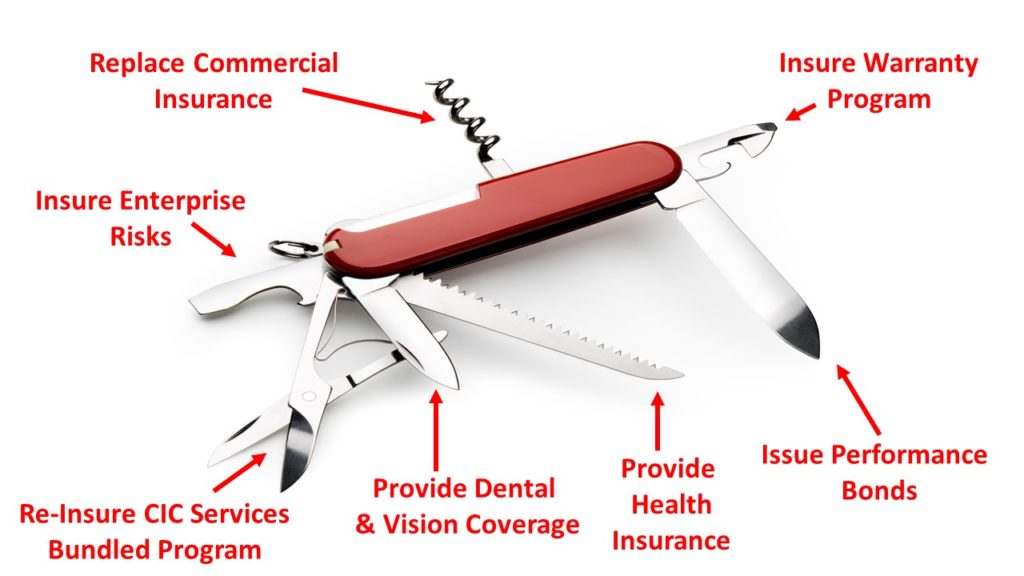

For mid-market and small companies, there are few entities more powerful than a captive insurance company. Captives are simply a choice to own your own insurance company, and they provide powerful risk management and financial benefits. Furthermore, captives are remarkably versatile, and for this reason, we are dubbing them as $wi$$ Army Captives. The $$$ signs are no accident. Captives help companies hold on to more of their hard-earned profits, and they can do it in a number of ways.

A critical element to remember is this: a captive may provide multiple types of coverage all by itself. This is particularly powerful for mid-market businesses because it provides scale benefits – allowing the costs of running the captive to be spread over multiple functions. A captive could insure one, some or all of the types of coverage in our $wi$$ Army Captive illustration below.

Control Costs

First, captives can take the place of some or all of a mid-market company’s commercial insurance, helping control costs. When the business experiences low or no losses, it is able to retain all insurance premiums paid to its captive as underwriting profits.

Enterprise Risk Management

Second, captives can provide all-encompassing protection to businesses by insuring enterprise risks. Enterprise risks are often operational or strategic (existential) threats businesses face that A) can severely cripple the business, and B) are often difficult to insure in the commercial market place. Enterprise risk insurance policies often have far fewer exclusions than commercial policies.

CLICK HERE to read about Enterprise Risk Management with a Captive.

Bundled Captive Insurance

Third, captives can help mid-market companies reduce their net commercial insurance premiums by up to 50% as part of CIC Services’ Bundled Captive Program, while providing A+ rated insurance coverage that matches their existing terms, limits, and pricing while being able to retain or select their insurance broker.

CLICK HERE to read about the Bundled Captive Program.

Warranty Programs

Fourth, captives can insure warranty programs. Many businesses provide warranties on their products or services either for free or at additional costs. Such warranties create exposure that can be insured by a captive. Also, many businesses sell third-party warranties on the goods and services they provide for a modest commission. Warranty programs often have low claims, and companies can often create “found money” by utilizing a captive to sell their own warranties and keep all warranty program profits versus giving them to a third party.

Performance Bonds

Fifth, captives can issue performance bonds. This can be a particularly powerful tool in construction or mining operations. Performance bonds are a sunk cost. Captives can enable companies with firm control of their losses to turn bonding into a profit center.

Additional Coverages

Finally, captives can be utilized to provide healthcare, vision and dental coverage as part of a company’s employee benefits plan. Properly structured, captives can help businesses lower their health insurance program costs by 15% to 30%.

Remember, a $wi$$ Army Captive can provide coverage for one, some or all of the above, and help mid-market businesses keep more $$$. To learn more about this service, contact CIC’s team of captive experts today!