Solving the Successful Business Owner’s Chief Conundrum

What is the successful business owner’s chief conundrum? Sure, business owners face many challenges, for instance, staffing, retaining talent, differentiation in a crowded market, keeping up with change, keeping pace with technology, capital investments, advertising, compliance, insurance, taxes, and a host of other challenges. And, these are enough to make one’s head spin. It’s certainly no wonder that over half of all business start-ups fail. So, what is the successful business owner’s chief conundrum?

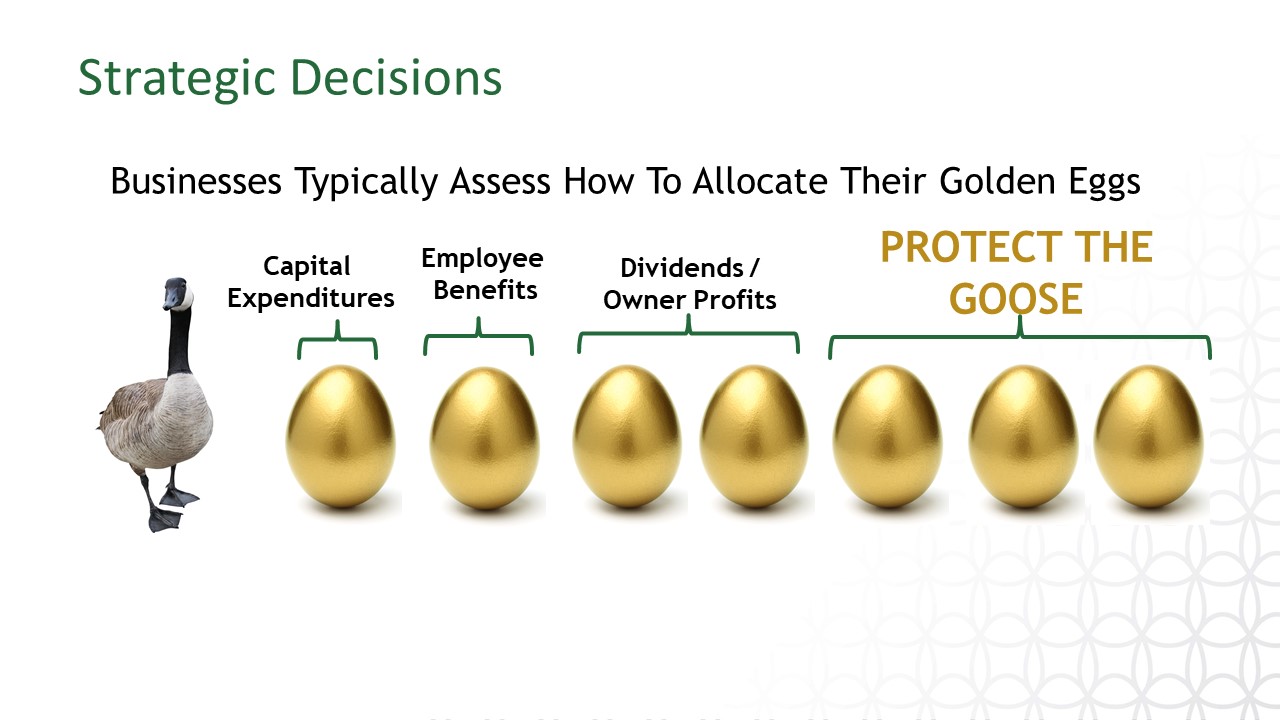

First, let’s define “successful business.” While there are many definitions of success, we will restrict our focus to businesses that have grown and succeeded to the point that they have something to lose financially. Their business is figuratively speaking a goose that is laying golden eggs.

Allocating the golden eggs can prove to be a real challenge. And, business owners often allocate a portion to capital and technology upgrades. Golden eggs can also be allocated to employee benefits and dividends for the owners. However, this brings us to the successful business owner’s chief conundrum – namely – how to protect the successful business that they have built. Protecting the goose is job one, and a portion of the golden eggs should be allocated to this end. But…how should they be allocated?

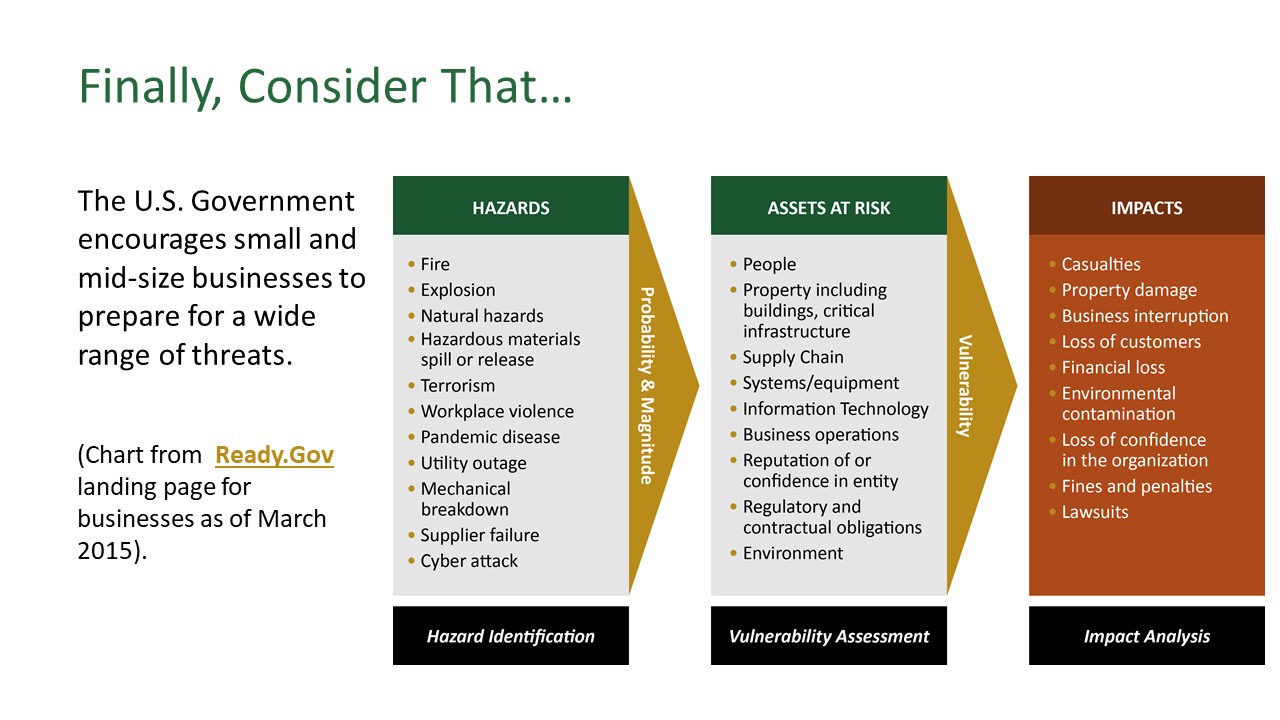

2020 clearly demonstrated that goose-killers abound, and the pandemic, civil unrest, and political turmoil have resulted in over 160,000 permanent business closures in the United States – a lot of dead geese and dashed dreams. Our Federal Government’s disaster preparedness web-site Ready.gov encourages businesses to be prepared for a wide range of threats that can cook their goose, as the chart from Ready.gov demonstrates (below).

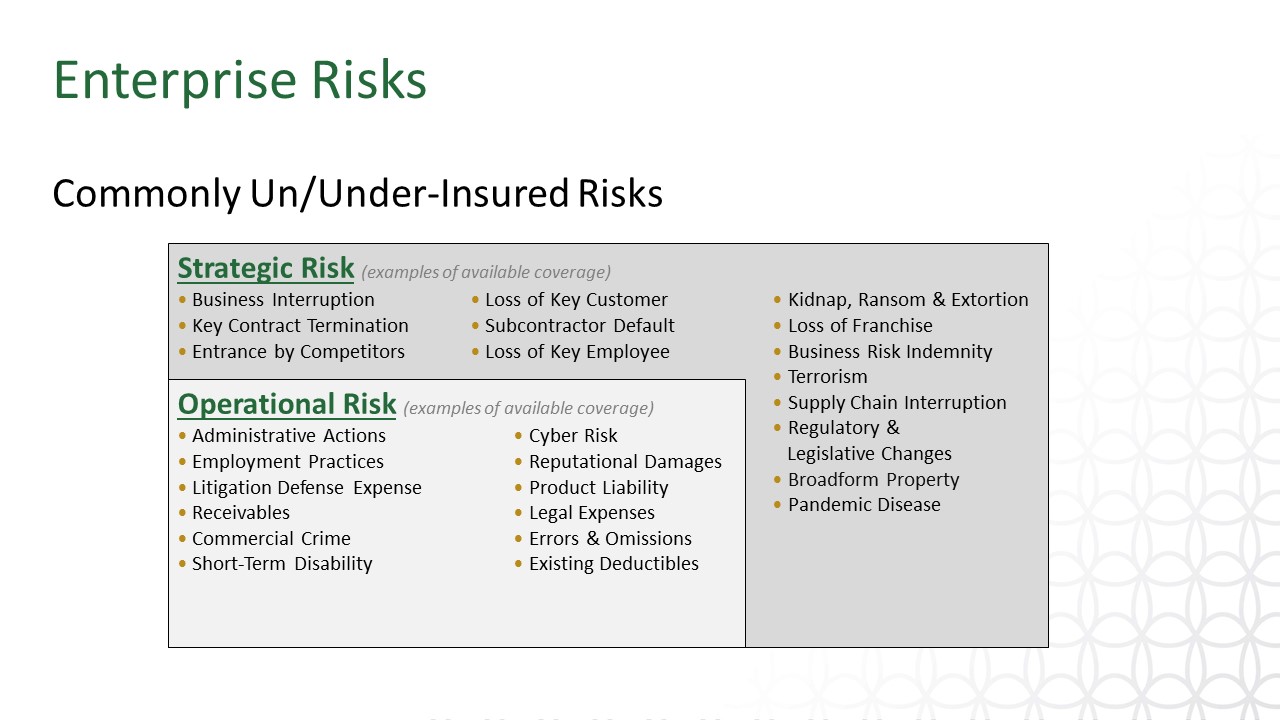

Not surprisingly, business owners normally turn to commercial insurance to protect their goose. But, is commercial insurance alone really adequate? Thousands of business owners thought they were insured for business interruption at the beginning of 2020, but they found out their business interruption policies only applied if their properties were actually damaged. Simply put, they weren’t actually covered. Also, a brief glimpse at the Ready.gov chart above or the common un/under-insured risks chart below makes it clear that it would be impossible or nearly impossible to address all goose-killers (or even most) without bankrupting the business, and retained earnings are a key component of any survival strategy.

The conundrum is rather daunting. Buy too little commercial insurance, and leave the business exposed. Buy too much insurance and drain company coffers with no meaningful carry-over into the future. A good loss history may result in lower cost increases in the future, but it almost never puts needed cash back into the business. With commercial insurance, the business owner plays a challenging game of roulette, where one has to be a loser to be a winner. If the business doesn’t lose (via a loss – importantly, a commercially insured loss), then the business really has nothing to show for it. The exception, of course, is peace-of-mind (which is valuable) and potentially lower rate hikes in the future.

So…the business owner has to be a loser to be a winner, but being a loser almost always means rate hikes in the future and even the risk of being dropped and being unable to acquire commercial insurance coverage.

The roulette analogy aptly applies, because a business owner may purchase numerous commercial insurance policies, draining cash out of the business, only to have a significant uninsured loss occur – crushing. If the owner bets on multiple numbers in roulette, there are inevitably numbers he or she hasn’t bet on. Each spin of the wheel can have a variety of outcomes and 2020 has shown us just how many numbers can pop up that business owners failed to bet on (EG were not covered by their commercial insurance).

So, in approaching the chief conundrum, successful business owners face a fork in the road. Do they commercially insure current un/under-insured risks? Or, do they choose not to insure them? And, if they insure them, which ones do they choose? Where do they place their bets?

Because, as we discussed before, with commercial insurance one has to be a loser to be a winner. Premiums paid for commercial insurance are a “sunk cost” – a sunk cost that robs much-needed funds from retained earnings.

The amazing news is that the conundrum can be solved! A business owner can choose to own his or her own insurance company, known as a captive insurance company (captive). A captive is a C Corporation and has a license to sell insurance policies to the parent company or related entities. As a licensed insurance company, a captive can re-insure or pool its risk with other unrelated captives (similar to a co-op) to spread the risk of loss. Importantly, premiums paid to the captive are not a sunk cost. If losses don’t occur and claims don’t materialize, the premiums paid to the captive are a sunk profit – profit in the insurance company owned by the business or business owner.

Remember our roulette analogy. Imagine a business owner stepping up to the table and placing their bets. The dealer spins the wheel and none of the bets are winners. However, rather than sweeping the business owner’s chips off the table into the house pot, the dealer returns all of the chips to the business.

Conundrum solved!

Want to boost your business in 2021? Learn more about Enterprise Risk Captives here.