Paradigm Shift – It’s Better To Insure Against “Rainy Days” Than It Is To Save For Them

My father always taught me to set aside money for rainy days. “You have to pay yourself first,” he would remind me. “Before you spend any money that you earn, you have to pay yourself by saving some money for a rainy day.” This was and still is great advice. And, of course, untapped “rainy day” money can always be enjoyed in the future.

Is the same advice true for businesses and business owners? It is… and it isn’t.

Most small and medium size businesses are under-prepared for “rainy days.” The 21st century economic, technological, political, regulatory, social and legal climate is very different than the climate businesses faced in the recent past. Simply put, businesses face far greater threats both in the spectrum of possible threats to a business and the magnitude or potential loss those threats pose. Most businesses insure common risks like theft, fire and general liability. However, there are a host of other potential “rainy days” that businesses face that are either specific to their industry or thrust upon them in the rapidly changing business climate.

Lawsuits are far more common in the current business climate, and lawsuits can come from both outside or inside a company. Businesses face more and more regulations, and it’s not uncommon to read a news article about a business crippled or closed down by regulators. Many businesses today also face cyber risks and threats to data security and IT systems. As if that is not enough, terrorism in the U.S. now poses a legitimate threat to businesses. And, many of these new “rainy day” threats cannot be covered affordably by typical third party insurance policies.

Informal Self-Insurance – The Typical “Rainy Day” Fund

The result is that many business owners choose to take the risk and save after-tax profits for future “rainy days.” Taking the risk can also be described as informally self-insuring risk. There are many reasons that business owners under-insure against the potential “rainy days” their business faces.

Why Not Over-Insure Against “Rainy Days”?

Because insurance is a sunk cost, businesses rarely want to be over-insured. Hence, the opposite occurs, and most are under-insured for real risks that could cripple or close their business.

Should Businesses Simply Buy More Third Party Insurance to Address the Myriad of Potential “Rainy Days” Facing Their Business?

In some cases, the answer may be “yes.” But, in most cases the answer is “no.” Insurance premiums paid to a third party commercial insurer are a SUNK COST. After a year or two or three or ten or twenty with no claims, a business is left at the end of the term with nothing to show for it. It’s that simple, there is nothing to show for all those insurance premiums paid. This forces businesses to be particularly selective about the insurance coverages they purchase.

So, Is A “Rainy Day Fund” The Best Solution?

A “rainy day fund” is certainly preferable to having no “rainy day fund.” These funds would usually be set aside as retained earnings in the business or as savings by the owner or owners. In either case (retained earnings or savings) both are set aside using after-tax dollars. A “rainy day fund” can be reserved to cover risks or threats to the business. This approach to risk management can also be described as informally self-insuring risk. In essence, informally self-insuring risk is choosing to take the risk and risk “taking the hit” should a loss or adverse situation occur.

How Does Informal Self Insurance Via A “Rainy Day Fund” Compare To Additional Third Party Commercial Insurance Coverage?

The positives of a “rainy day fund” are that it provides some risk management, gives a business financial flexibility and avoids the “sunk cost” of purchasing additional third party commercial insurance. The negatives of a “rainy day fund” as both a risk management and financial tool are that it is funded with after-tax dollars and provides reduced dollars for loss mitigation in the event of an adverse event.

The positives of purchasing additional third party commercial insurance are that it provides far more financial recompense should a loss occur and it is funded with pre-tax dollars. The greatest negative of purchasing additional third party coverage is that premiums paid are a sunk cost. Also, many standard insurance policies contain provisions, caveats and policy limits that can result in a loss being only partially covered or not covered at all.

Stop Right There. This Article Is Titled “Definitive Proof – It’s Better To Insure Against ‘Rainy Days’ Than It Is To Save For Them.” How Is That Possible?

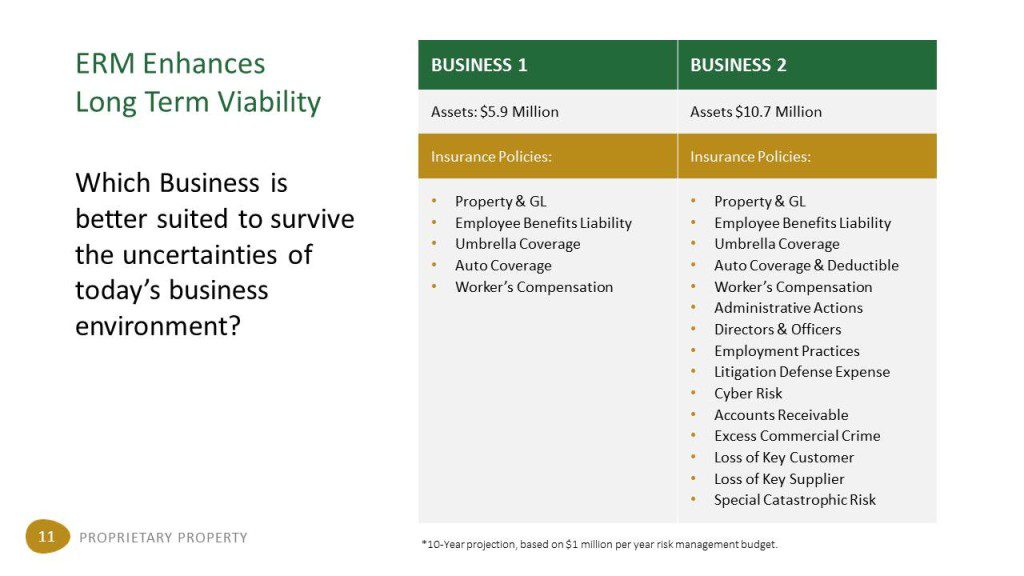

It is possible because there is a solution that eliminates the trade-offs outlined in the preceding paragraphs. A business owner can implement Enterprise Risk Management (ERM) utilizing a Captive Insurance Company (CIC) as the chassis to formally insure against “rainy days.” ERM is comprehensive approach to prepare for all possible “rainy days” a business could face. Specifically, ERM is defined as the discipline by which an organization in any industry assesses, controls, exploits, finances and monitors risks from all sources for the purpose of increasing the organization’s short and long-term value to its stakeholders.

It’s far more effective to insure against a “rainy day” via ERM with a Captive Insurance Company, because this approach results in BOTH more insurance and more money for future “rainy days.”

The illustration below shows why ERM with captive ownership is better than a traditional “rainy day” fund. It compares the status quo on the left with ERM implementation and captive ownership on the right. Status quo includes third-party commercial insurance and a traditional “rainy day” fund. ERM includes third party commercial insurance, insurance provided by the CIC and a “rainy day” fund comprised of CIC reserves. This illustration covers a 10 year period and assumes a 4% rate of investment return for both scenarios. Both businesses have $1 million per year of profits (that could be applied to risk management). Each year, the business on the left pays taxes on $1 million and sets aside retained earnings as its “rainy day” fund. Each year, the business on the right purchases $1 million of insurance from its captive insurance company. After 10 years, the business on the right which implemented ERM with a captive insurance company has more insurance coverage and more money. In fact, over a ten year period, the business on the right has almost 80% more wealth than the business on the left. Which of these businesses is better prepared for the inevitable “rainy day” in the future?

This is proof positive that ERM with a CIC can help business owners avoid being under-insured without the “sunk cost” of paying insurance premiums to a third party insurer and having nothing to show for it. The business or business owner or related parties own the captive insurance company. Hence, the premiums paid to the captive to insure risks faced by the business are not “sunk costs.” They are insurance reserves – a robust “rainy day” fund – owned by the captive owner.

Furthermore, ERM with a CIC allows owners to customize their insurance coverage. Said another way, policies can be written to perfectly address the business’ identified risks as well as gaps. And, policies can be written without the various exclusions and caveats that are contained in most third party commercial insurance policies.

Also, captive insurance companies are real insurance companies, and they operate like real insurance companies. As such, their reserves set aside to pay claims are not taxed. Small insurance companies, defined as receiving annual premiums of $2.2 million or less, may make an 831 (b) tax election. CICs making an 831(b) tax election are taxed at a zero percent (0%) rate on their underwriting profit. Underwriting profit is simply defined as premiums received less claims paid.

Assuming a combined tax rate of 50% (federal and state), a business or business owner can essentially double the “rainy day” funds set aside in a captive insurance company versus the funds set aside in a traditional “rainy day” fund to pay for losses incurred by the business. Furthermore, the captive insurance company is now able to invest and grow a much larger pool of funds – essentially twice the pool. So, by implementing ERM and owning a captive insurance company, a business owner can turn his or her “rainy day” fund into a “rainy week (or month)” fund!

What Is A Captive Insurance Company?

Simply put, a captive insurance company is a closely-held insurance company that insures primarily thought not exclusively your business. It is a C corporation and is licensed and domiciled like any large insurance company. Captives also have their own reserves, policies, policyholders, and claims. Insurance policies are issued by the captive to its parent or related companies and are actuarially priced. Owning a captive insurance company is a sophisticated way to self-insure, and captives are generally formed to insure the risks of a business, group of businesses and related or affiliated third parties.

How Does a Captive Insurance Company Work?

A captive primarily insures its parent company or related companies. Hence, the parent company is able to purchase insurance from its captive, and it can insure risks that third party insurers will not insure or risks where third party insurance cost is unaffordable.

Premiums are paid from the parent company to the captive with pre-tax dollars. The captive can invest its assets mostly as its owners choose (some domiciles have restrictions).