How Would War Impact Your Business? – Most Businesses Are Underinsured – Part 2

Crisis Group recently reported that “The world is entering its most dangerous chapter in decades,” and, “The sharp uptick in war over recent years is outstripping our ability to cope with the consequences.” In a recent report titled “10 Conflicts to watch in 2017” Crisis Group’s CEO, Jean-Marie Guehenno, wrote about the dangers of local, regional and even global conflict in 2017. According to Mr. Guehenno, the top 10 trouble spots for 2017 are:

- Syria and Iraq

- Turkey

- Yemen

- Greater Sahel and Lake Chad Basin

- Democratic Republic of Congo

- South Sudan

- Afghanistan

- Myanmar

- Ukraine

- Mexico

Of particular concern, Mexico, our neighbor to the South is in the Top 10. While not listed in the Top 10, Guehenno also pointed out that East Asia, including China, is a volatile region as well. According to Guehenno, the world has changed considerably since the Cold War.

Without a predictable order, widely accepted rules, and strong institutions, the space for mischief is greater. The world is increasingly fluid and multipolar, pushed and pulled by a diverse set of states and nonstate actors — by armed groups as well as by civil society. In a bottom-up world, major powers cannot single-handedly contain or control local conflicts, but they can manipulate or be drawn into them: Local conflicts can be the spark that lights much bigger fires.

To read the entire article at CrisisGroup.org, CLICK HERE.

And this brings us back to our original question: How would war impact your business?

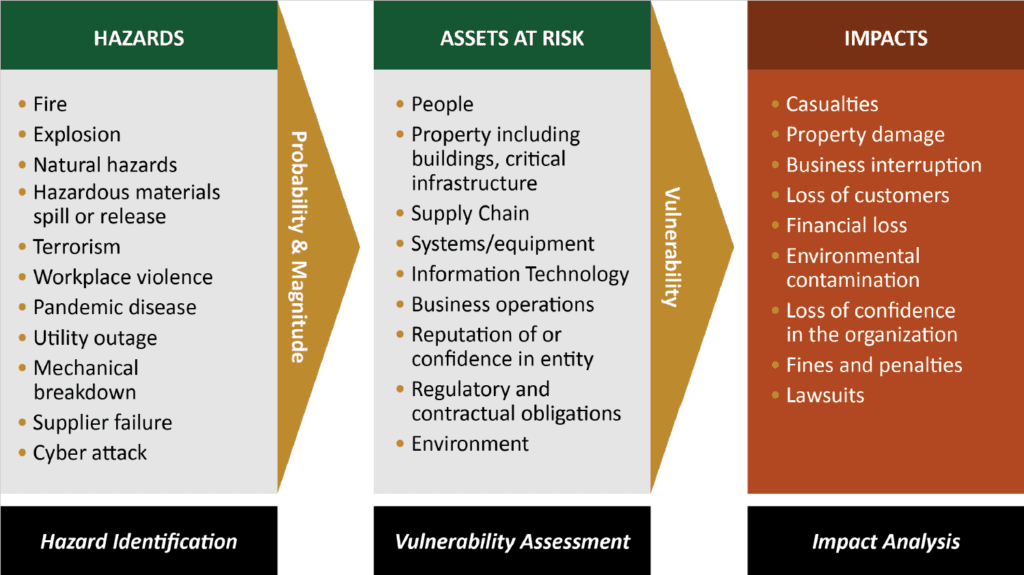

The uncertainty of international conflict requires greater preparedness on the part of businesses and suggests a compelling need for successful small and mid-size businesses to own their own insurance company. In today’s inter-connected and global business climate, conflicts, sanctions or embargos could have a serious impact on many small and mid-size businesses. Clearly, the prospect of international conflict in the next ten years is real and daunting. Most businesses are underinsured. At a minimum, most could benefit from robust insurance policies addressing:

- Business Interruption

- Supply Chain Interruption

- Loss of Key Customers

- Kidnap and Hostage Situations

- Terrorism

- Indirect Losses Caused by Any of the Above

Pondering the Crisis Group Report raises three key questions.

- Why don’t most small and mid-size businesses carry the robust insurance policies outlined above?

- Should most small and mid-size businesses carry the robust insurance policies outlined above?

- Is there a better alternative?

Let’s start with question 2. The answer is usually “yes.” All business owners must do a cost / benefits analysis when taking on business expenses and planning the future of the business. Decisions concerning risk management, risk management systems and insurance are no different.

Which brings us to question 1. In doing a cost / benefit analysis (even if it’s a simple mental exercise), there are numerous obstacles to placing a business in a heightened risk management posture, including the purchase of the robust insurance policies outlined above. As we have noted in prior Captivating Thinking articles, third party commercial insurance is a sunk cost. Yes, the business owner benefits from peace of mind, and, in many cases, compliance with laws requiring minimum insurance coverage. However, if the business doesn’t suffer losses and file claims, all money paid in premiums is gone forever.

It’s not difficult to imagine a scenario, where a healthy business would spend thousands of dollars to purchase millions of dollars of insurance coverage for supply chain, loss of key customers and business interruption. In an increasingly uncertain world, these types of coverage are expensive with costs likely to escalate in the future. After five years, the business owner drops coverage to increase investment in a capital project. As fate would have it, a regional war ensues and cuts of access to a key supplier, crippling the business. Five years of insurance premiums paid are down the drain and of no use as the business owner struggles to survive, possibly laying off talent, losing key customers, or even choosing to close the business.

In addition to third party commercial insurance coverage being a sunk cost, it’s important to note that most insurance policies are riddled with exclusions. In the example above, imagine if the business owner had supply chain insurance, but the U.S. government declared the regional conflict an act of terrorism – not war. If the supply chain interruption policy excluded terrorism, the insurance policy purchased is worthless.

This brings us full circle to question 3. The great news is that there is a better way. Congress provided small and mid-size business owners a far superior alternative when it passed the Tax Reform Act of 1986. This legislation was passed by a Democrat controlled Congress and signed by a Republican President (a true piece of bi-partisan cooperation) and paved the way for “small” captive insurance companies. This legislation was a real game changer for small and mid-size businesses, because it made it feasible and affordable for small and mid-size businesses to own their own insurance company – specifically, a captive insurance company. Large corporations had owned captive insurance companies for decades, but until 1986, they were effectively out of reach for smaller businesses, which are the real backbone of U.S. employment and job creation.

Importantly, it didn’t stop there. Congress wanted to encourage small and mid-size businesses to significantly improve their risk management and survivability posture, so it built in a tax incentive known as the 831(b) tax election. Commercial insurers and large captive insurance companies already received tax advantaged treatment, because they operated under insurance law. The 831(b) tax election simplified accounting and operations for “small” captives.

Captives overcome the trade-offs outlined above. Businesses can improve risk management, buy the robust insurance policies desperately needed in uncertain times and be covered by insurance policies with few or no exclusions. Most importantly, captives overcome the sunk cost dilemma outlined above because the business owner or owners own the insurance company. The genesis of “small” captives is one of the great benefits of the Ronald Reagan and Tip O’Neill era.