Businesses Are Under-Insured for the Coronavirus Pandemic

The Coronavirus which recently infected humans in China is showing all the signs of being a worldwide epidemic, and will likely touch almost every country on the planet. It will quite possibly impact the majority of people either directly or indirectly. It is almost certain that it will also have a jarring effect on the global economy and business.

In fact, businesses in the U.S. are already feeling the blow. The CHICAGO TRIBUNE recently reported that “Chicago businesses are vulnerable as Coronavirus spreads,” and “We’re really going to find out how tied every country in the world is to China.”

Read the entire February 5 article in the CHICAGO TRIBUNE – CLICK HERE.

The article points out that:

The U.S. economy has weathered overseas events in the past, including the SARS outbreak in 2002 and 2003, but China’s economy has grown significantly since then. Illinois firms that source products from China’s factories or depend on sales to its consumers are keeping a close eye on the virus’ spread.

“We’re really going to find out how tied every company in the world is to China,” said James Green, director of risk advisory services for Chicago-based risk management firm SAI Global.

Supply chain interruptions are starting already and will get far, far worse before this is over.

Electronic device manufacturer Morey Corp. typically plans several weeks in advance this time of year, since the Chinese factories it uses regularly shut down for the holiday. But Tanveer Khan, the company’s director of strategic sourcing, said he’s concerned about the Woodridge-based company’s bottom line if the delays continue.

“Each week is putting us behind,” he said. “We have enough inventory to last us for four weeks, but thereafter we will be in trouble.”

Mondelez International, maker of Oreos and Chips Ahoy, expects the coronavirus to affect its first-quarter revenue, though it’s too soon to say by how much, CEO Dirk Van de Put said last week during an earnings conference call with analysts. China accounts for $1 billion of Mondelez’s annual revenues, or about 4.5%, he said.

Since 2005, CIC Services has been helping businesses prepare for the unexpected – fortuitous events like pandemic disease, supply chain interruption, catastrophic risks and business interruption, which are often difficult or cost-prohibitive to insure commercially. For years, we have been sharing advice from our Federal Government’s disaster preparedness website – Ready.Gov.

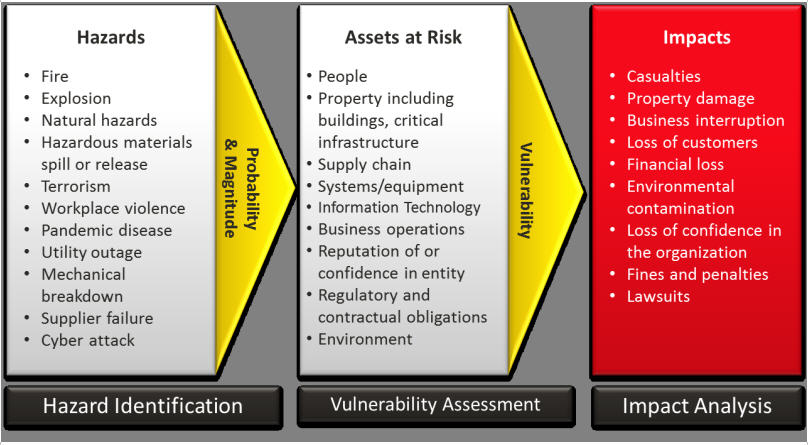

Ready.Gov has specific guidance for small and mid-market businesses, summarized in the table below.

Notice that Ready.Gov encourages business owners to be prepared for a wide range of threats, including pandemic disease, terrorism, supply chain interruption, and business interruption. In light of the recent spread of the Coronavirus, the inclusion of pandemic disease on Ready.Gov’s list is quite prescient.

In addition to developing contingency plans for all of the threats listed by Ready.Gov, businesses can insure against many of these risks. However, commercial insurance for these types of asymmetrical threats can be extremely costly or difficult to obtain. And in many cases, coverage is simply unavailable.

For these reasons, captive insurance is often one of the best approaches for mid-market and small companies to prepare for the unexpected and not only manage a crisis but potentially even thrive in a crisis. Captive insurance is simply a choice to own your own insurance company. Captives are licensed insurance companies and are able to gain access to reinsurance pools or the reinsurance markets to provide a backstop for risks they insure. A captive is a form of self-insurance that enables businesses to participate in a portion of their own risk. Businesses buy insurance from their captive and are able to retain the profits accumulated in their captive. Captives also receive favorable tax treatment – just like commercial insurance companies – to help them accumulate loss reserves. Captive loss reserves not paid out in claims or expenses accumulate from year to year. This accumulation of loss reserves can pay claims to the business in the event of an insured loss and provide a powerful defense against the unexpected, including the impact from pandemic disease, supply chain interruption and business interruption – which appears to be looming in the shadow of the bad news coming out of China these days.