Now More Than Ever Congress Wants Business Owners To Own Their Own Insurance Company

Every year, millions of Americans, hundreds of thousands of business owners, states, counties and municipalities make decisions based on what Congress wants them to do.

For example, every year countless business owners purchase new vehicles or equipment when their old vehicles and equipment are perfectly serviceable. They make this capital upgrade because newer, better equipment benefits their business AND they experience significant tax benefits as well. Why would Congress offer tax benefits to purchase new vehicles or equipment? Well, there are a myriad of reasons. New vehicles and equipment may be more energy-efficient – think green. They may help create manufacturing jobs and support U.S. industries.

Congress may want U.S. businesses to be strong, and new vehicles and equipment help ensure business strength. New equipment may include financing which stimulates the banking industry. The list goes on. Or, consider the mortgage interest deduction and 401(k) which are specifically designed by Congress to encourage homeownership and retirement savings for all Americans.

It’s no secret that Congress uses tax laws to incent businesses to alter their behavior. This includes incenting behaviors like hiring more workers, providing education to employees, choosing green energy, buying or accelerating the purchase of new equipment and, even, owning your own insurance company. Clearly, business owners aren’t going to make a ridiculous purchase just to reap a tax benefit.

Congress wants small and medium-sized businesses to own their own insurance company, known as a captive insurance company (Captive). In the mid-80s, Congress passed captive insurance legislation that established the 831(b) tax election for small insurance companies. This legislation opened the door for many small and mid-sized business owners to enjoy the same benefits of Captive ownership that large corporations had enjoyed since the 1950s. And, 2020 has many similarities to 1986, including a hardening commercial insurance market, which is making commercial insurance more difficult and more expensive to purchase. Layer on a global pandemic and civil unrest and the case for small and middle-market companies owning their own insurance company is even more compelling.

Congress wants small and mid-sized businesses to own their own Captive for a variety of reasons. Captive ownership isn’t the right move for all businesses, but for many businesses, the pros of Captive ownership outweigh the cons of Captive ownership. 2020 has clearly demonstrated that most small and middle-market businesses need more insurance protection AND more money, and a Captive is the only strategy that delivers both simultaneously. A few reasons Congress encourages Captive ownership are as follows:

- Most businesses are under-insured but don’t want to buy more commercial coverage (or can’t reasonably afford it)

- Businesses that own a Captive typically benefit from a vastly improved risk management approach

- Businesses that own a Captive tend to be forward-looking and better prepared to weather adverse events in the future

- Captive ownership boosts long term business viability which, in turn, is good for the economy and good for employees

- Captive ownership enables businesses and business owners to build loss reserves, reap insurance profits and grow wealth

What Is A Captive Insurance Company?

What Are The Benefits Of Owning A Captive Insurance Company?

Second, the overall (or aggregate) wealth of one or more companies with a captive insurance company is almost always higher – significantly higher – than the overall wealth of companies without a captive insurance company. This occurs for two primary reasons. First, the parent company takes an expense as it pays its insurance premium to its captive. This lowers the parent company’s taxable income. And, the captive may be eligible to make an 831(b) tax election and be taxed at a rate of zero percent (0%) on its underwriting profit (assumes premiums of $2.3 million or less annually). It’s worth noting that in 2017, this limit increased from $1.2 million to $2.2 million and is now pegged to inflation – MORE PROOF THAT CONGRESS WANTS BUSINESSES TO OWN THEIR OWN INSURANCE COMPANY! Second, the captive is able to earn a return on its reserves (or assets). And, the captive’s asset pool has been amassed with favorable tax treatment, enabling asset growth on a larger starting base.

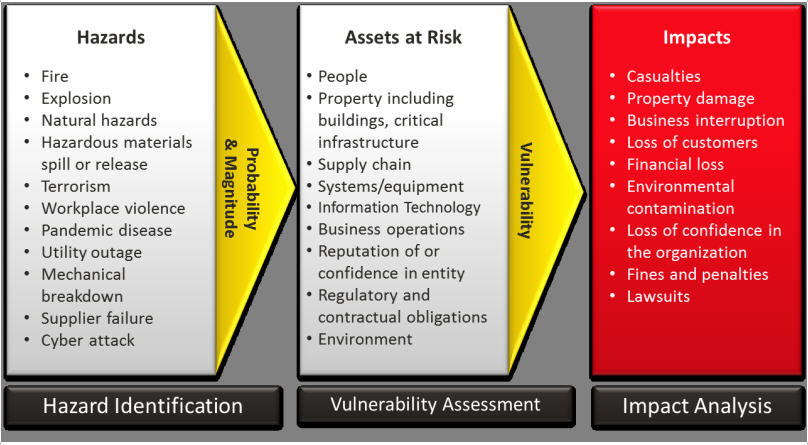

There are numerous risks that many businesses regularly face and informally self-insure. Which means that if an event occurs, the business “bites the bullet,” often taking a loss, laying off workers and possibly facing partial or total closure (as many have done in 2020). It’s impossible to know what the 20’s will hold, but it’s reasonable to expect more calamity and crises. With a small Captive in place, making an 831 (b) tax election, businesses can formally insure risks not normally insured by third party insurers.

Adverse events are going to occur whether or not a business has a captive insurance company in place. Businesses with a captive in place have a much larger pool of funds to address adverse events (typically 60% to 80% more) because captive assets receive favorable tax treatment.

Over time, a well- structured captive can help ensure the survival of the business and often double a business owner’s wealth. For small and mid-size business owners, this is one place where Congress “has your back.”

Learn More About Captive Insurance – CLICK HERE.