The Best Self-Insurance Money Can Buy – ERM With A CIC

CIC Services, LLC Principal and Founder, Tom King has described Enterprise Risk Management (ERM) with a Captive Insurance Company (CIC) as “THE BEST SELF-INSURANCE MONEY CAN BUY.”

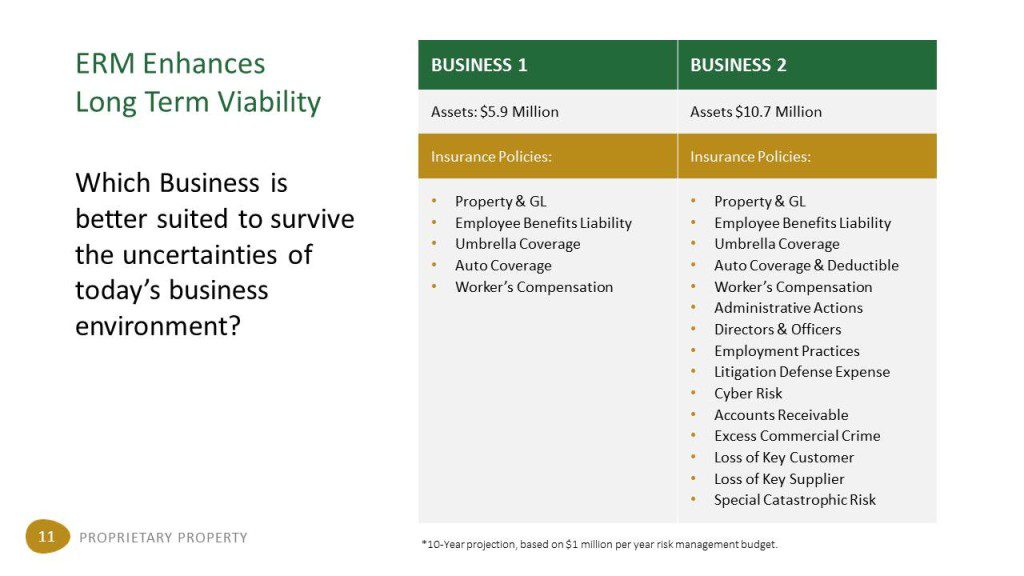

Consider the chart below that visually depicts the game-changing benefits of implementing an Enterprise Risk Management (ERM) approach with one or more Captive Insurance Companies (CICs).

We are aware of no other risk management and financial vehicle that affords its owners the array and magnitude of benefits that captive insurance companies do. By choosing to own their own insurance company, a business owner or CFO is able to simultaneously have more insurance protection and more money at their disposal.

The chart below compares the same business, choosing two different paths. Continuing with the status quo is represented on the left, and ERM implementation with captive ownership is represented on the right. This illustration covers a 10 year period and assumes a 4% rate of investment return for both scenarios. Both businesses have third party insurance coverage in place to insure core risks. The business on the right which implements ERM with a Captive Insurance Company has both more insurance coverage and more money. In fact, over a ten year period, the business on the right has almost 80% more wealth than the business on the left.

Today, small and mid-size business owners face far greater challenges than their predecessors faced. In fact, they are far more likely to face existential threats that can completely wipe out their operations. For instance, cyber risk is a growing and wildly unpredictable threat. Terrorism and impact from international conflicts are very real threats to businesses and their operations (Even if a business isn’t directly targeted, how long can most businesses last without power…without infrastructure…without key suppliers…without key customers?).

Spending a little time on Ready.Gov, the U.S. Department of Homeland Security’s business preparedness web-site, puts the threats listed above into perspective. These threats are real and their impact can be catastrophic. Ready.Gov notes that “40% of businesses affected by a natural or human-caused disaster never reopen.”

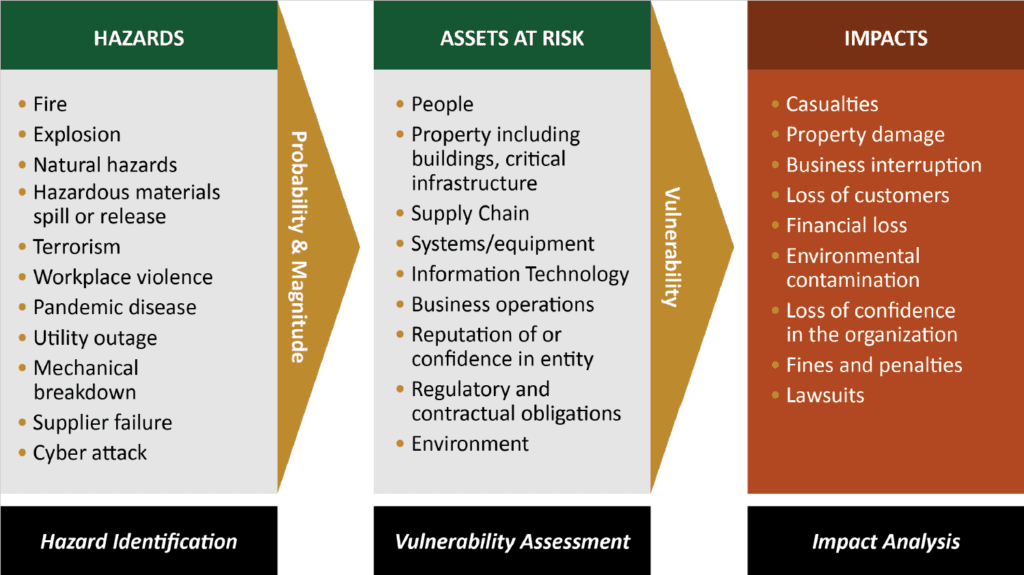

The government web site recognizes that low-frequency and high-impact risks are the ones that pose the greatest threats to small and mid-size businesses. Addressing small business disaster preparedness, Ready.Gov notes that:

- “Businesses can do much to prepare for the impact of the many hazards they face…including natural hazards like floods, hurricanes, tornadoes, earthquakes, and widespread serious illness such as the H1N1 flu virus pandemic.

- Human-caused hazards include accidents, acts of violence by people and acts of terrorism.

- Examples of technology-related hazards are the failure or malfunction of systems, equipment or software.”

Illustration From Ready.Gov On Threats Facing Small Businesses

Consider “Human-caused hazards [like] terrorism.” Ready.Gov makes it clear that any business, large or small, in the U.S. could be impacted by terrorism. Businesses should have business interruption insurance for lost revenue caused by terrorism including chemical, biological or nuclear attack. Businesses should also be insured for business interruption caused by failure of the power grid (due to natural disaster, terror attack or a solar storm). Also, businesses should have robust business interruption insurance to cover lost revenue in the event of a pandemic disease in the U.S. It is not inconceivable that the government would confine all non-essential workers to their homes for 30, 60 or 90 days to stem a national emergency.

In addition to the existential threats covered above, small and mid-size business owners face risks posed by their own governments – local, state and federal. Government regulators wield more power than in bygone days. Overzealous government regulators often “shoot first and ask questions later.” They often have the power to shut down a business until a dispute can be resolved by the courts.

Finally, litigation is an ever-increasing threat to business owners, and the dangers come from inside and outside of their businesses. Business owners and their staffs must navigate a complex maze of employment laws, healthcare laws, worker’s compensation laws, environmental laws, tax laws and many other laws that can result in costly lawsuits. Also, many commercial insurance liability policies will cover damages, but do not cover punitive damages awarded in a lawsuit. In many cases, punitive damages awarded to plaintiffs are 3 to 10 times higher than compensatory damages.

In our twenty-first century complex, global and ever-changing business climate, is third party, commercial insurance sufficient by itself?

In addition to property & casualty insurance, how much business interruption insurance is enough?

How much insurance would be required to offset the impact of lost trust and a sullied brand or tarnished reputation?

Is it possible to purchase insurance for everything that could go wrong?

And, even if a business owner could, what would it cost?

The Third Party Insurance Dilemma

It’s a truism that the most needed types of insurance either are not available in the third-party insurance market or are often prohibitively expensive. For instance, it’s nearly impossible to get third-party insurance at any price that would provide coverage in the event your business was harmed in a nuclear attack. Is that because the risk off loss is too remote? Hardly. It’s because, regardless of how likely such an attack may be, its impact on your business would be extraordinary.

Even when you can get reasonably priced third-party insurance to protect against a given risk, the drawbacks are significant:

- Policy limits cap coverage

- Policy exclusions limit coverage

- Many policies are “cookie cutter” and based on a generic risk model that most businesses face rather than one customized for your business

- Claims drive up the future cost of insurance

- Marketing and distribution costs (commissions, commercials, etc.), as well as corporate overhead and profit margins, are built into premiums

Most importantly, the biggest drawback to third party insurance is that premiums paid are a sunk cost. Unless claims are made, insurance payments are always lost money (with the exception of buying peace of mind). This lost money – lost paying insurance premiums today – reduces a business’ flexibility in the future (and, we will speak to this point later – see “War Chest” below).

A Better Way – Enterprise Risk Management – Blending Third Party Insurance With Formal Self-Insurance

For many, a far more powerful approach to risk management that overcomes the trade-offs just noted is Enterprise Risk Management that results in a layered or blended approach. By combining third party insurance with a captive insurance company, a business owner can establish a far more comprehensive and thorough risk management approach. ERM is also a better forward looking approach, because the captive insurance company will accumulate additional reserves in years with low claims. These ERM reserves can provide more robust insurance coverage in the future and, when necessary, can be accessed by the owner (or CFO) as a war chest to address contingencies or unanticipated risks.

What Is A Captive Insurance Company?

Simply put, a captive insurance company is a closely-held insurance company that insures primarily thought not exclusively your business. It is a C corporation and is licensed and domiciled like any large insurance company. Captives also have their own reserves, policies, policyholders, and claims. Insurance policies are issued by the captive to its parent or related companies and are actuarially priced. Owning a captive insurance company is a sophisticated way to self-insure, and captives are generally formed to insure the risks of a business, group of businesses and related or affiliated third parties. A captive (or captives) form the chassis of a small / mid-size business ERM strategy.

Why Is ERM With A CIC The Best Self-Insurance Money Can Buy?

A CIC is one of the most powerful risk management and wealth accumulation tools that a business can access. When properly employed, there is nothing else that can do what a captive insurance company does. By operating their own insurance company as part of ERM, business owners and CFOs can:

Fill Third Party Gaps

A captive insurance company can issue insurance policies that address gaps not covered by third party insurers. Captives can also insure third party insurance deductibles, enabling the parent company to raise its deductible and lower its third party insurance costs. Also, a business can enjoy more broad business interruption coverage with ERM and a CIC when an adverse event occurs, particularly events where third party insurance doesn’t cover all damages or peripheral damages.

Utilize Customizable Coverage

Captive insurance companies can write customizable coverage for the businesses they insure. Many businesses face unique risks that may not be addressed by commercial insurers. Unique coverages can also be very expensive when covered by commercial insurers. This feature enables business owners and CFOs to say, “this has gone wrong in the past, let’s insure against it in the future,” or “other companies have experienced this adverse event, we can insure this via our captive.” The flexibility afforded by a ERM with a captive is extremely beneficial in a complex world.

Benefit From Few Or No Policy Exclusions

Captives can provide broad coverage without the exclusions that riddle typical commercial insurance policies. Insurance coverage is worthless if an exclusion prevents the insured from receiving a claims payment when it needs it most.

Avoid Sunk Cost Of Third Party Insurance

Premiums paid to a captive insurance company remain the property of the captive owners (usually the business or business owners). One of the reasons that most businesses are underinsured is that purchasing insurance is a bit like purchasing a lottery ticket. If you don’t win (or in the case of insurance, experience an adverse event resulting in a claim), your money is gone with nothing to show for it. With a captive, this simply isn’t the case. Profits in the captive, defined as premiums collected less claims paid, belong to the captive owners.

Gain Access To A War Chest

Over time, businesses, owners and CFOs can build up a substantial war chest with ERM and a captive insurance company. This war chest is available to pay insurance claims the business may have. And, it can also be accessed should the owner or the business require funds. Assets accumulated in a captive almost always outpace retained earnings or a business’ “rainy day fund.” Because the captive is a formal form of self-insurance, it benefits from insurance law and favorable tax treatment. Hence, it is able to accelerate asset accumulation for two main reasons.

First, premiums paid to the captive receive favorable tax treatment. Premiums paid to the captive are an expense to the parent company. This lowers the parent company’s taxable income. As, the captive takes in premiums, it is taxed as an insurance company on its underwriting profits (typically defined as premiums less reserves to pay future claims). For large insurance companies, underwriting profit is actuarially determined. However, small insurance companies can make an 831 (b) tax election, resulting in a tax rate of 0% (that’s zero percent) on their underwriting profit. A small insurance company is defined as receiving premiums of $2.3 million or less per year.

Second, the captive is able to invest and grow larger pool of assets. Large commercial insurers have entire staffs whose sole purpose is to invest reserves (that have not been taxed).

For these reasons, ERM with a well-run captive insurance company will typically double retained earnings. And, the same claims that would be paid by the captive would have to be covered out of retained earnings anyway if the captive weren’t in place.

Enjoy The Ability To Reap Long Term Profits

When business owners are ready to sell their business or retire, they keep the war chest. A successful captive amasses wealth for its owners that can be accessed and enjoyed in the future. This unique ability to improve risk management and simultaneously stockpile wealth makes captive insurance companies THE BEST SELF-INSURANCE MONEY CAN BUY.

What Is The CIC Services Difference?

The primary reason for forming a captive is ALWAYS risk management.

All risk management is Financial. A financially strong captive is a more powerful risk management tool.

CIC Services LLC structures captives to optimize both risk management and asset accumulation. The greater the asset accumulation, the more effective the captive is for its insureds and owners. We do this through the following:

- Comprehensive Business Risk Assessment

- Compliance with IRS Safe Harbors

- Strategic Risk Management Plan

- Superior Structuring within a Captive

- Superior Asset Management Strategies

- Superior Exit Strategies