Alternative Risk Transfer (ART) describes the marketplace in which nontraditional risk transfer approaches (as compared to commercial insurance) can be arranged. Some of the types of entities and approaches included in this marketplace are captive insurance companies (Captives), pools, trusts and risk retention groups (RRGs). ART typically includes some form of self-insurance (formal or informal, complete, partial or shared) and enables entities to:

1) Retain all or a portion of their risk.

2) Retain all or a portion of insurance profits.

3) More closely align their risk management program with the risks of the insured(s)

4) Tie their insurance costs more closely to their own loss experience.

5) Stop subsidizing the poor performance of unrelated risky businesses with their hard-earned premium dollars.

2020 overwhelmingly demonstrated the importance of ART approaches as commercial insurance rarely covered business interruption caused by COVID-19 and civil unrest.

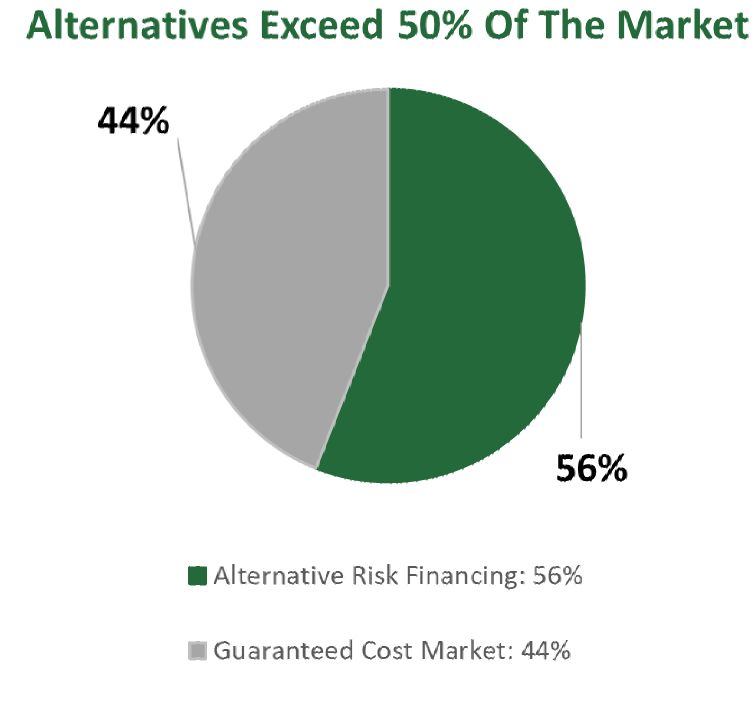

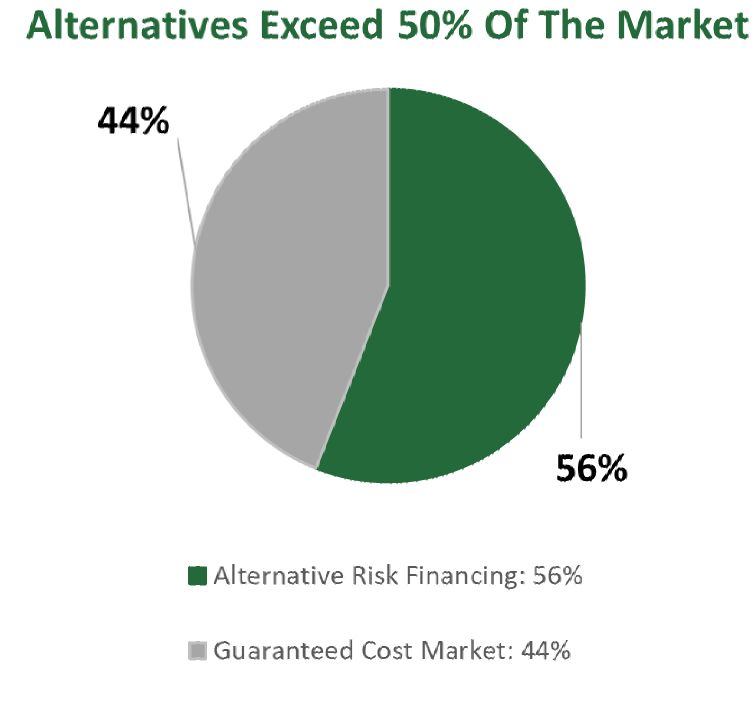

AM Best indicates that Alternative Risk Transfer market is the largest premium segment of the insurance industry (over 56% of every insurance dollar is placed in an ART market). As can be seen, more and more of the smART money has moved into the ART market. Also, Forbes indicates that over 90% of Fortune 500 companies utilize Alternative Risk Transfer through the use of captive insurance programs.

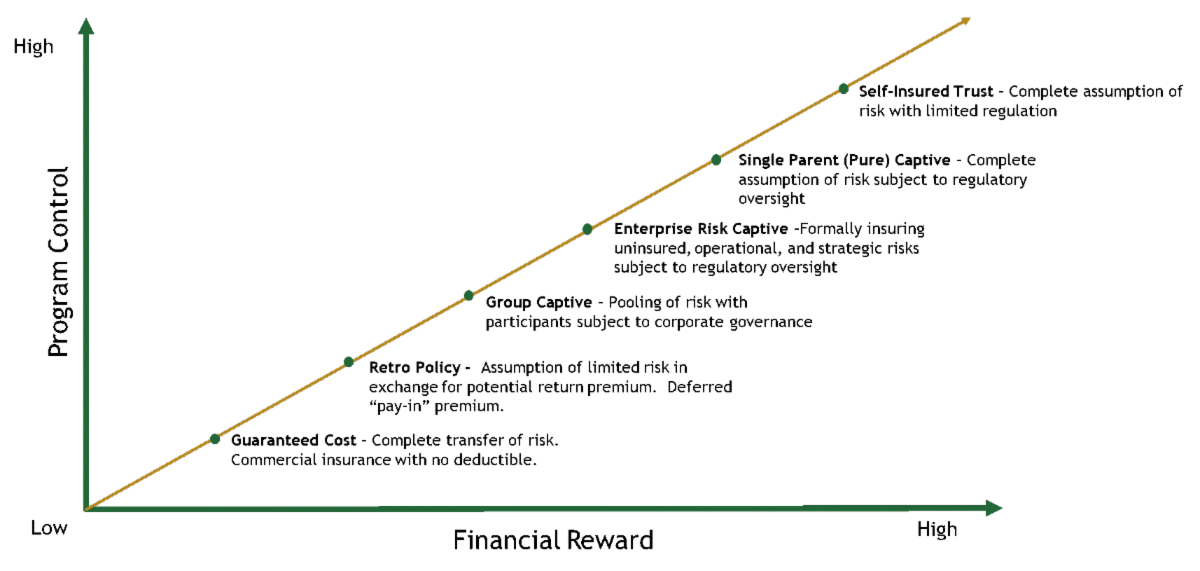

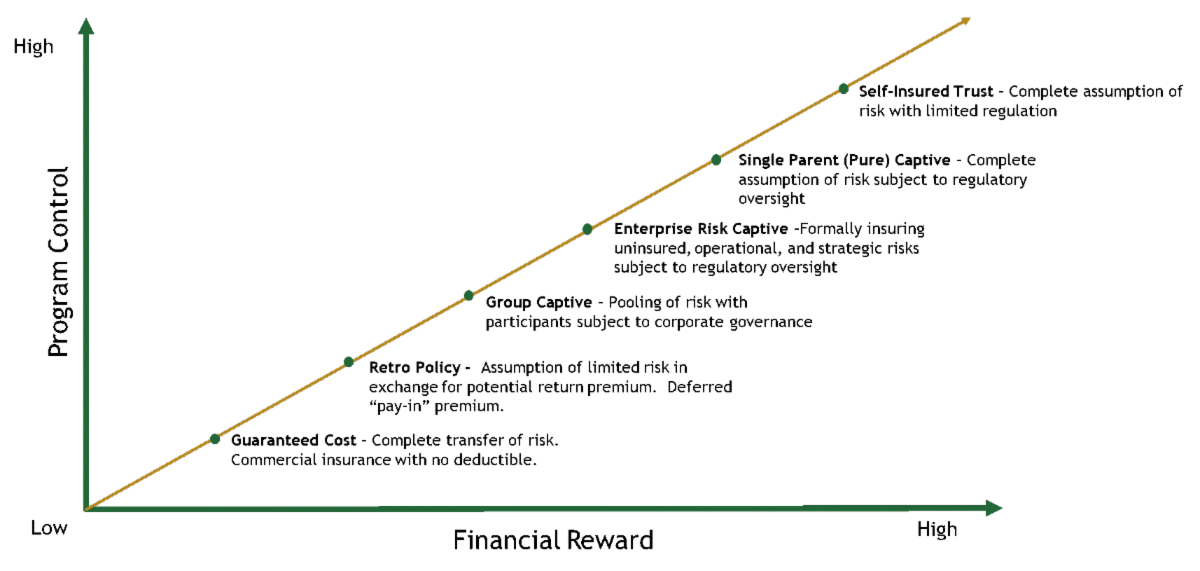

ART comes in many forms and can be understood via the chart below. It plots ART approaches on a continuum from lower program control / lower financial reward to higher program control / higher reward. Notice that the lowest program control / lowest financial reward to the business or business owner is the “Guaranteed Cost” market in the bottom left (also known as the commercial insurance market). Conversely, the highest program control / highest financial reward program is a Self-Insured Trust (upper right corner).

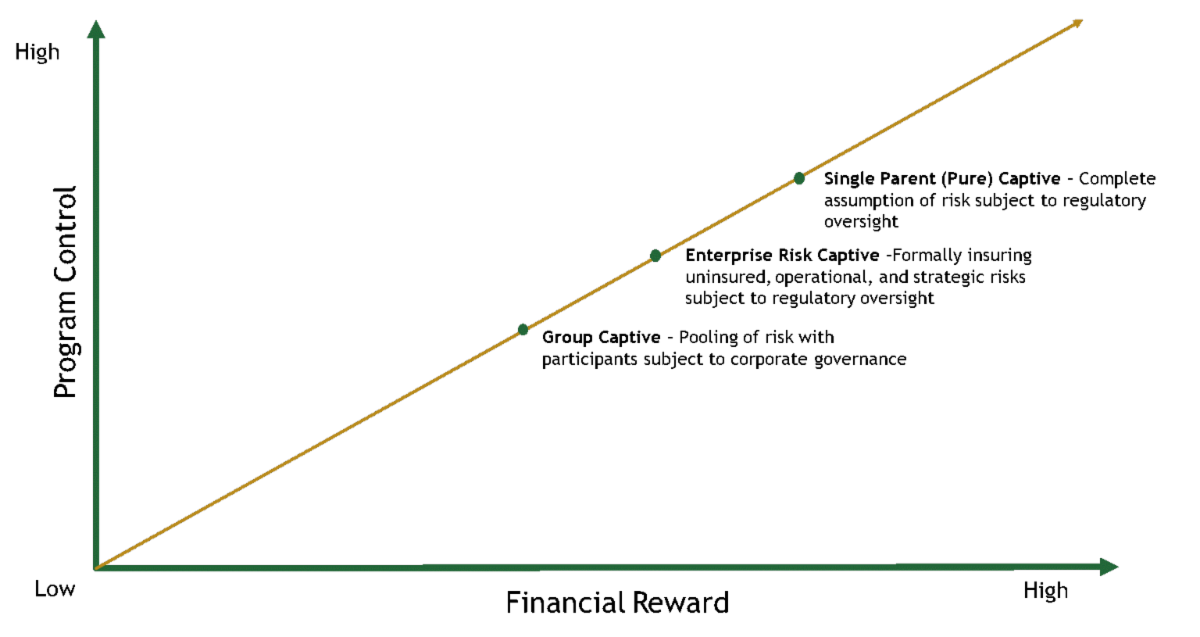

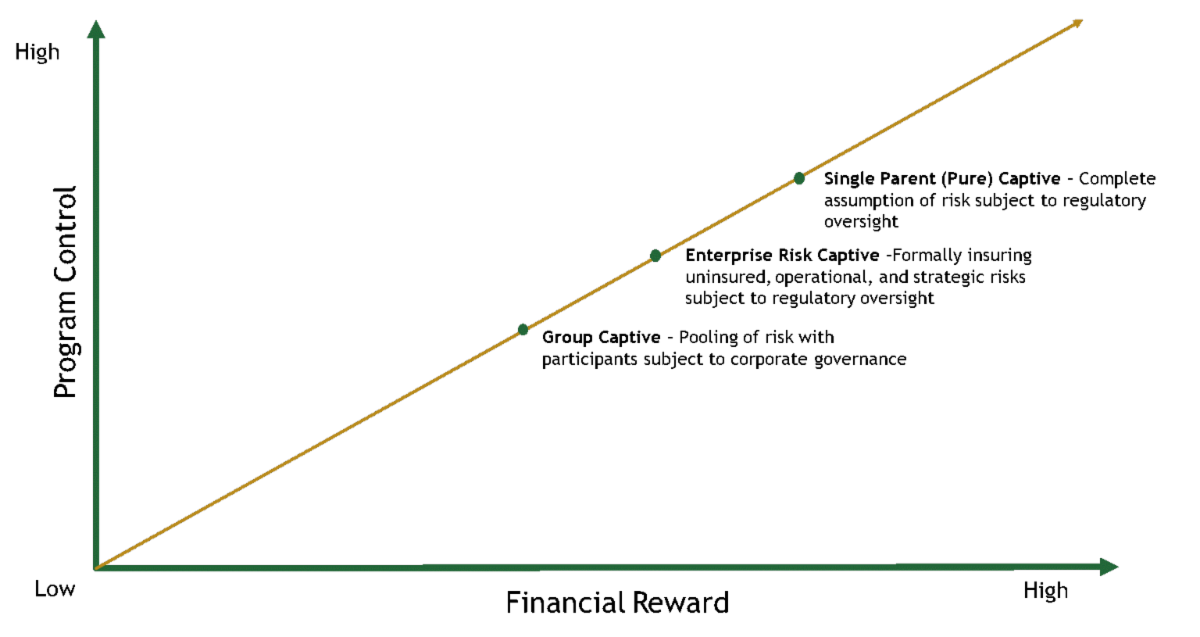

CIC Services is a captive manager, and for purposes of this article, we will focus on three ART approaches in the middle of the continuum (as diagramed below). They are Group Captive, Enterprise Risk Captive and Traditional Captive. ART helped many middle-market companies weather the 2020 storm.

What Is A Captive Insurance Company?

A Captive Insurance Company is a real insurance company (with policies, policyholders, claims, reserves and surplus), licensed in an appropriate jurisdiction, formed to insure the risks of its owners and sometimes third parties. Captives are generally owned by the same economic interest as the primary company(ies) they insure, resulting in the capture of all underwriting profits by the business owner(s). Captives have been in existence since the 1950s and insure businesses in virtually every industry and sector of the market. There are an estimated 7,000 current world-wide captives. Industry studies have estimated that there are currently over 100,000 businesses that are currently qualified to own a captive. If more companies owned captives, it’s likely that some business failures in 2020 could have been reduced. At a minimum, successful business owners (often job creators) would have at least had the capital to start over.

What is a Group Captive Insurance Company?

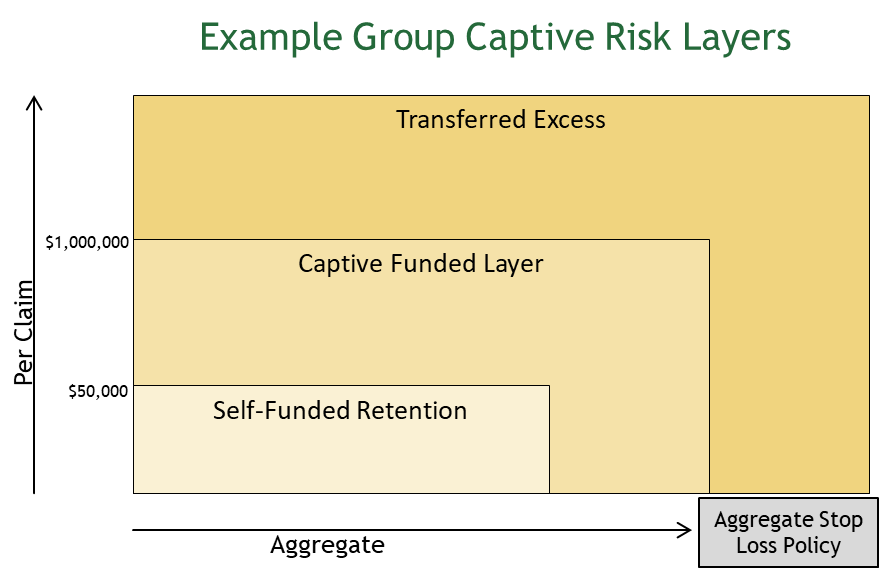

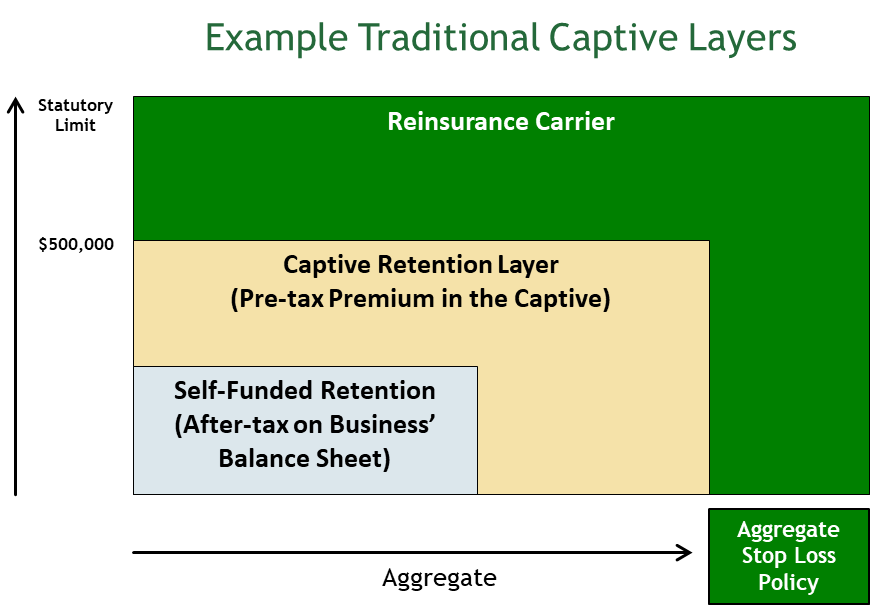

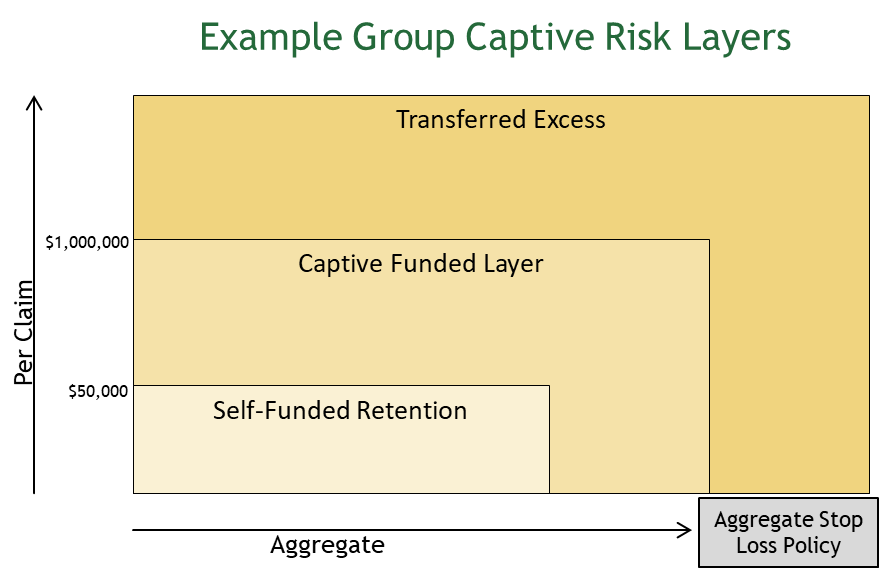

Group Captives are designed to help members decrease the costs of their existing commercial insurance programs (typically Worker’s Compensation, General Liability, Professional Liability, etc.). In this arrangement participants purchase a minority share of an existing group captive facility in exchange for the ability to participate in the program. A Group Captive utilizes the combined buying power and premiums of participants to negotiate greater control and terms for its membership. Group captive programs typically layer and share risk at pre-determined levels. This layering allows for members to participate in owning their risk without being exposed to catastrophic claims. Frequency and severity type claims are further siloed to protect participating members (see the illustration below). Generally speaking, Group Captive members are able to receive dividends based upon the performance of their risk management program.

What is an Enterprise Risk Captive Insurance Company?

Enterprise Risk Captives are designed to protect the long-term health of a business(es) by insuring a broad spectrum of risks and accumulating wealth as loss reserves.

They can essentially turn risk management into a profit center. These captives allow owners to formally insure risks inherent in their business that are otherwise not insured (or under-insured) by the commercial market. Health insurance, loss of key employees, warranties and legal expenses are good examples of risks often protected in this arrangement. These captives are typically owned by closely-held/family businesses and insure high severity / low frequency risks. They often make an 831(b) tax election, allowing them to be more cost effective and enabling them to accelerate the build-up of loss reserves to better protect the insureds.

What is a Traditional Captive Insurance Company?

What is a Traditional Captive Insurance Company?

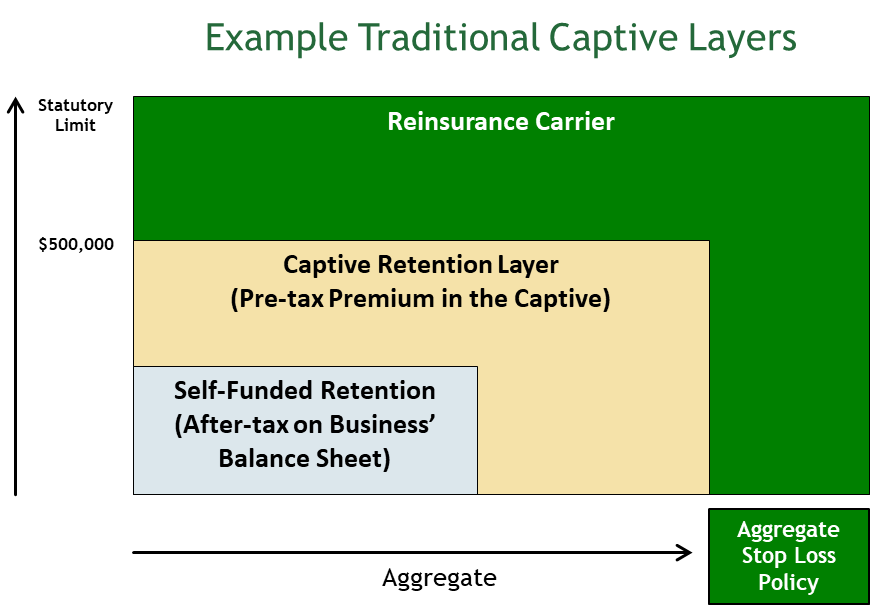

These programs are typically used by larger organizations to completely replace lines of insurance that are written in the traditional insurance marketplace. These companies are typically owned by more sophisticated organizations that desire more control over their claims process, coverage terms, and have the balance sheet and risk appetite to take advantage of their size. These programs are often utilized to completely replace Workers’ Compensation, General Liability, Auto Liability and many other coverages that typically remain in the commercial market. Similar to group captives, traditional captive programs typically layer and transfer risk at pre-determined levels. This layering allows for insureds to participate in owning their risk without being exposed to catastrophic claims. Frequency and severity type claims are further siloed to protect insureds.

The SmART Move

For many businesses and business owners, the ART marketplace is the smART move. The ART market can reward businesses for above-average loss histories and excellent risk management practices. It can also help business owners turn their risk management program into a profit center. And, most importantly, ART can be the key to survival, even in a year like 2020. What could be smARTer than that?

Learn more about Captive Insurance!

What is a Traditional Captive Insurance Company?

What is a Traditional Captive Insurance Company?