Uncertainty Abounds – Most Businesses Are Underinsured

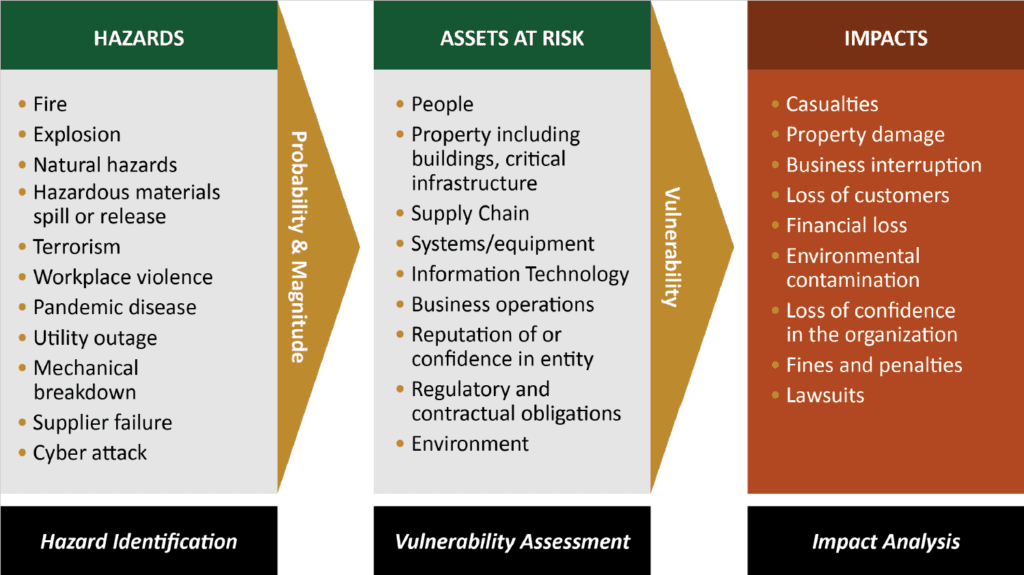

| 2017 is off to a fast start, and one thing is certain. Businesses face increasing uncertainty today’s interconnected global economy. Recent headlines have been dominated by immigration, border walls, political instability, terrorism, data breaches, cyber crimes and employment lawsuits. Unfortunately, most small and medium size businesses are underinsured. Today, businesses face far greater risks than similar businesses faced in the past. In addition to common (or “core”) risks like theft, fire and general liability, there are a host of other risks that businesses face that are specific to their industry and exacerbated by shifts in the political landscape, technology, regulations and the legal system.

Lawsuits are far more common in the current business climate, and lawsuits can come from both outside or inside a company. Businesses face more and more regulations, and it’s not uncommon to read a news article about a business crippled or closed down by regulators. Many businesses today also face cyber risks and threats to data security and IT systems. As if that isn’t enough, terrorism in the U.S. now poses a legitimate threat to companies. And, many of these “new” risks are not covered by typical third party insurance policies. These types of coverage often require additional policies that are often very expensive. In increasingly uncertain times, what do small and mid-size business owners need most? Of course, different businesses have different needs. However, without a doubt, almost all would benefit by having: 1. More Insurance 2. More Money In fact, it could be argued that successful businesses can’t have too much insurance and too much in cash reserves. That seems obvious. But, doesn’t more insurance mean less money? Aren’t they mutually exclusive? They don’t have to be. And, here is the most important point. It is possible to significantly increase both insurance and cash reserves simultaneously by owning a Captive Insurance Company (CIC) as part of an Enterprise Risk Management (ERM) strategy. Owning a captive insurance company is an approach to formally self-insuring risks facing a business or businesses. |

| What Is The Difference Between Formal And Informal Self-Insurance?

Businesses that don’t own their own captive insurance company (CIC) as part of an Enterprise Risk Management (ERM) strategy are informally self-insuring some of their risks (those not insured by third party coverage). The result is that business owners “take the risk” and may “bite the bullet” if adverse events occur. Informally self-insured losses are paid out of operating income, retained earnings or the owner’s savings. There are many reasons that business owners under-insure the risks their business faces. One of the biggest reasons is that insurance premiums paid are a SUNK COST. After a year or two or three or ten or twenty paying insurance premiums with no claims, a business is left at the end of the term with nothing to show for it. It’s that simple, there is nothing to show for all those insurance premiums paid… except for peace of mind. Why Not Over-Insure For Risks With Third Party Insurance? Because insurance is a sunk cost, businesses rarely want to be over-insured. Hence, the opposite occurs, and most are under-insured for real risks that could cripple or close their business. How Does Owning A Captive Insurance Company Afford Business Owners With More Insurance And More Cash Reserves? The formation of a captive insurance company can help business owners avoid being under-insured without the “sunk cost” of paying insurance premiums to a third party insurer and having nothing to show for it. The business or business owner or related parties own the CIC as part of an ERM strategy. Hence, the premiums paid to the captive to insure risks faced by the business are not “sunk costs.” They are insurance reserves and profits owned by the captive owner. Furthermore, by choosing to formally insure risks through a captive, business owners benefit from insurance law and taxation. Premiums paid by the business to the captive are a business expense, reducing taxable income. Small captive insurance companies are taxed on their underwriting profits at a tax rate of zero percent (0%). Small captive insurance companies are defined as receiving $2.2 million or less in annual premiums. CICs are able to invest and grow large pools of assets.

|

| What Is A Captive Insurance Company?

A captive is a unique insurance company. It includes its own corporation, insurance license, reserves, policies, policyholders, and claims. It is a formal way for business owners to self-insure risk, and captives are generally formed to insure primarily though not exclusively the risks of one or more businesses owned by the same or related parties. How Does a Captive Insurance Company Work? A captive primarily insures its parent company or related companies. Hence, the parent company is able to purchase insurance from its captive, and it can insure risks that third party insurers will not insure or risks where third party insurance cost is unaffordable. Premiums are paid from the parent company to the captive with pre-tax dollars. The captive can invest its assets mostly as its owners choose (some domiciles have restrictions).

|