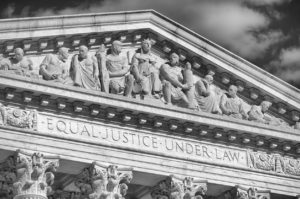

Supreme Court to hear CIC Services IRS case

Captive Review covers the recent decision of the Supreme Court of the United States to review the decision made last year in CIC Services vs. IRS. The lawsuit challenges Notice 2016-66, which targets captive insurance owners.